FTX Debtors have filed a motion to enlist Mike Novogratz’s Galaxy Digital to provide hedging and liquidation services for the FTX Bankruptcy Estate’s cryptocurrency portfolio. The deadline for any objection is September 6th 2023, and the ultimate decision will be made on September 13th, 2023 at 1 PM EST.

It makes sense to hire professionals to liquidate the estate, to hopefully avoid any more major blunders a’la SUI. You can read the full documents here: https://restructuring.ra.kroll.com/FTX/Home-DocketInfo (#2240)

The estate holds a mix of major cryptocurrencies such as Bitcoin & Ethereum, both of which are listed as “hedging assets”, which Galaxy will hedge to protect the USD value, but not liquidate. All other cryptocurrency assets are to be liquidated (most prominently solana).

Galaxy’s Fees

Galaxy Digital will receive a hedging fee of 0.005 * (days in month / 365) * average USD NAV (a 4.1 BP fee for a 30 day month); and a liquidation fee (for assets sold) of 0.00075 * USD value of assets (7.5 bps). These fees seem reasonable, and comparable to exchange fees, the main factor for the estate is how much they can acquire for their assets.

Request for Wavier of Bankruptcy Rule 6004(H)

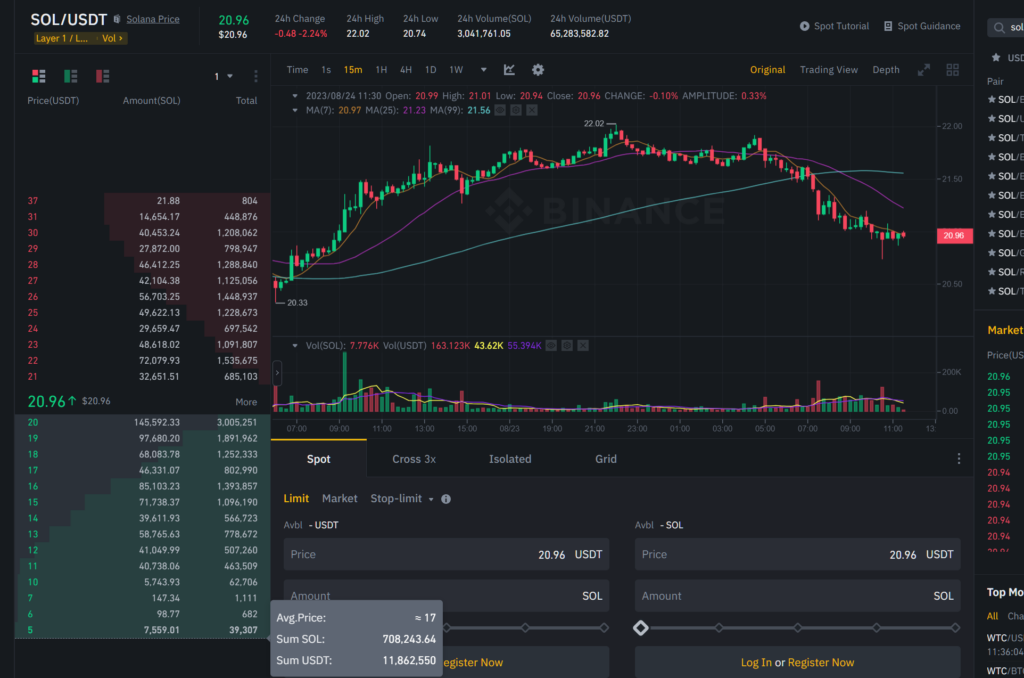

This is probably the most critical piece of this document, in terms of maximizing creditor value. FTX owned a large % of total Solana supply, if they are forced to liquidate this under normal bankruptcy conditions, they would crash the price & receive a terrible transaction cost.

I believe the primary reason for retaining Galaxy is so that they can liquidate key assets in a far more efficient manner. Given the current state of cryptocurrency markets, and the fact Binance’s spot exchange only has $11m worth of liquidity for SOL to 0, trying to dump that quickly is obviously not a good plan.

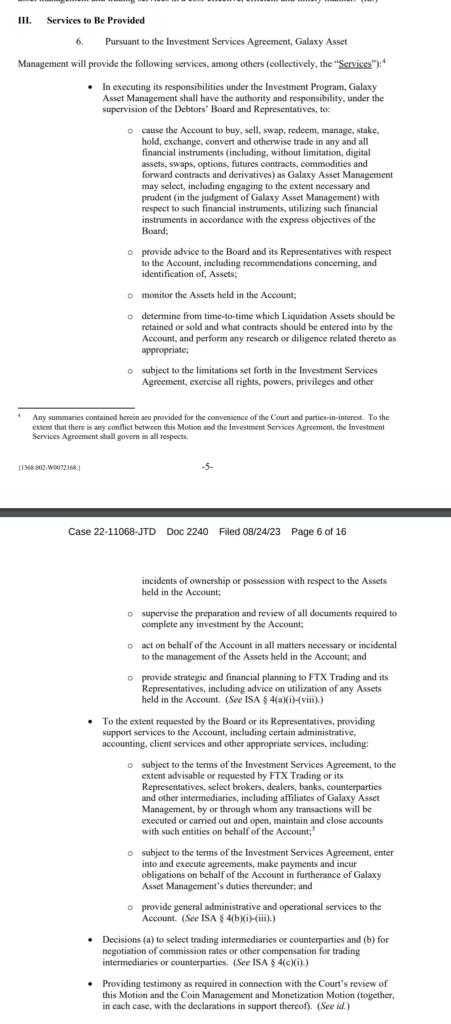

The Services Agreement

Exhibit B contains the agreement, I’ve highlighted 2. above which contains some of the more interesting information. Every coin other than BTC & ETH will be liquidated, and BTC & ETH will be hedged using derivatives.

Galaxy is instructed to seek the best liquidation price for the liquidation assets, and ultimately is given most of the discretion in terms of how to achieve the best execution price. This agreement to me seems written with a clear understanding of market dynamics, and acknowledges in the below 4(ii) the sensitivity of the situation.

Conclusion

From the overview here, I think the estate has made a wise decision outsourcing the asset liquidation to experts rather than attempting to do a fire sale. I imagine there will be significant market impact, especially on Solana and other tokens heavily held by the FTX estate.

Leave a Reply