The beginning

I have a long history with FTX, I was one of the first customers of the platform (I heard about a few days after launch and was immediately intrigued by the selection of coins, and USD collateral). This was also around the beginning of my Twitter account’s existence, at the time the CEO was very engaged with the small userbase and we both had fewer than 1000 followers.

In the early days almost all liquidity was provided by Alameda Research, a quantitative trading firm headed by Sam Bankman-Fried, who also ran FTX. Sam got the idea for the exchange after publishing a white paper with requests for what he’d like to see in exchanges and no exchange taking it up.

At first the UI was rough, the platform felt clunky but the groundwork was laid. BitMEX was constantly freezing with overloads, and COI concerns, ByBit was a newcomer, but they had few coins and Binance Futures was but a twinkle in CZ’s eye. FTX quickly started to gain share, and all was well for a while.

Early Concerns

Many had rightful concerns about the exchange owners also being the principle market makers. In fairness most exchanges starting up without a built in audience had to bootstrap liquidity somehow, especially for a highly leveraged futures exchange. In my experience the liquidity was usually top tier, and nowhere else offered such a selection of altcoin futures with leverage.

A small exchange, DueDex, which has since gone out of business decided to run a paid FUD campaign against FTX. It’s rather ironic given DueDex was clearly faking volume & despite their claims had an internal market making desk. I briefly was involved as an affiliate, but canceled my relationship after seeing the defamatory articles they were paying others to write.

Another group, Bitcoin Manipulation Abatement LLC filed suit against Alameda & FTX at this time. BMA alleged that Alameda had intentionally ran a “momentum ignition” algorithm on Binance Futures with the intention of liquidating clients. The suit was ultimately tossed, and personally I find incompetence more plausible than malice here. Such a setup wouldn’t be profitable, as Binance Futures had barely any volume at the time.

One other incident worth mentioning back in the early days is sometime in 2019, Alameda’s market making software had an outage. This lead to massive spreads on every coin, and could highlight some competency issues on their end. They were nice enough to compensate all effected users and all was forgiven.

Binance Enters the ring

Towards the end of 2019, Binance would announce a strategic investment into FTX, which immediately gave the platform an air of legitimacy. CZ also buried the hatchet over market manipulation concerns on Binance Futures.

Binance listed FTX’s leveraged tokens on Binance, and the two were very friendly, at least initially. Binance Futures took the crypto market by storm, and by early 2020 had taken the lead ahead of FTX & BitMEX. FTX seemed undeterred and carried on as usual, the platform was still growing and all was mostly well.

I personally saw no reason to leave for ‘greener pastures’ as the experience on FTX had been mostly positive, and the CEO seemed like a good guy. As a side note my crypto account really took off in late 2020, going from 5 to 7 figures in the span of a few months, which was great, but also what ultimately lead to my concerns.

Cracks Emerge

Early 2021, I decide to withdraw half of my money from FTX to my bank account for financial security, I also start collecting my transaction history & PNLs to plan for taxes. Immediately I notice something very concerning, the historical PNLs for certain days were hugely inflated, followed by a huge negative day the next day.

This was alarming, the moment I discovered this I wrote a poorly worded twitter thread (where I speculated on the issues and said FTX was insolvent, which at the time was a stretch), and wanted to pull all of my money. I had a withdrawal whitelist option enabled and I needed to whitelist a BTC address (previously I had only withdrawn fiat, but I didn’t trust FTX to deliver that in time, I thought we were potentially in the final hours).

In addition after writing the first thread, I received some concerning DMs. Non USD Fiat withdrawals hadn’t been moving in weeks, in hindsight this was probably an issue with Deltec, not FTX, but that was extremely alarming.

I hadn’t been able to sleep for several days while I still had a sizable percentage of my net work on the platform, waiting 3 days for the whitelist. This was around the period I took the twitter account down, as I received a few very aggressive DMs, and wasn’t sure what to do. I also heard around this time of another incident, I wont go into details, but it made me increasingly confident I was right about FTX’s competence.

Another thing that really set me off was a few threads on Sam’s twitter account, highlighting (IMO) a concerning view on risk. The first thing was his view on the Kelly Criterion being that it under risked, and that he favored a linear wealth utility function over a logarithmic one. I recalled he also posted a tweet once about how Alameda ‘almost stopped existing’ implying some sort of over leveraged disaster, and was somewhat concerned.

Another was a thread on covid with some rather absolutist takes. He thought that rather than waiting to test the vaccines, we should have used them immediately, there’s a clear lack of second order thinking here (it does work from the PoV that they would pass the clinical trials, but you only know that from hindsight bias). It’s not on it’s own important, but I became concerned about the risk management and second order thinking of the company.

One last thing I should mention is the stadium, some people legitimately thought “Alice thinks FTX is going bust because they bought a stadium”. It was another concern, because it’s building up fixed expenses in a volatile industry and also to me indicates a poor focus. Financial companies that spend big on flashy marketing have a very poor history (See: eTrade, Refco), you want conservative management focused on the product, not massive ads.

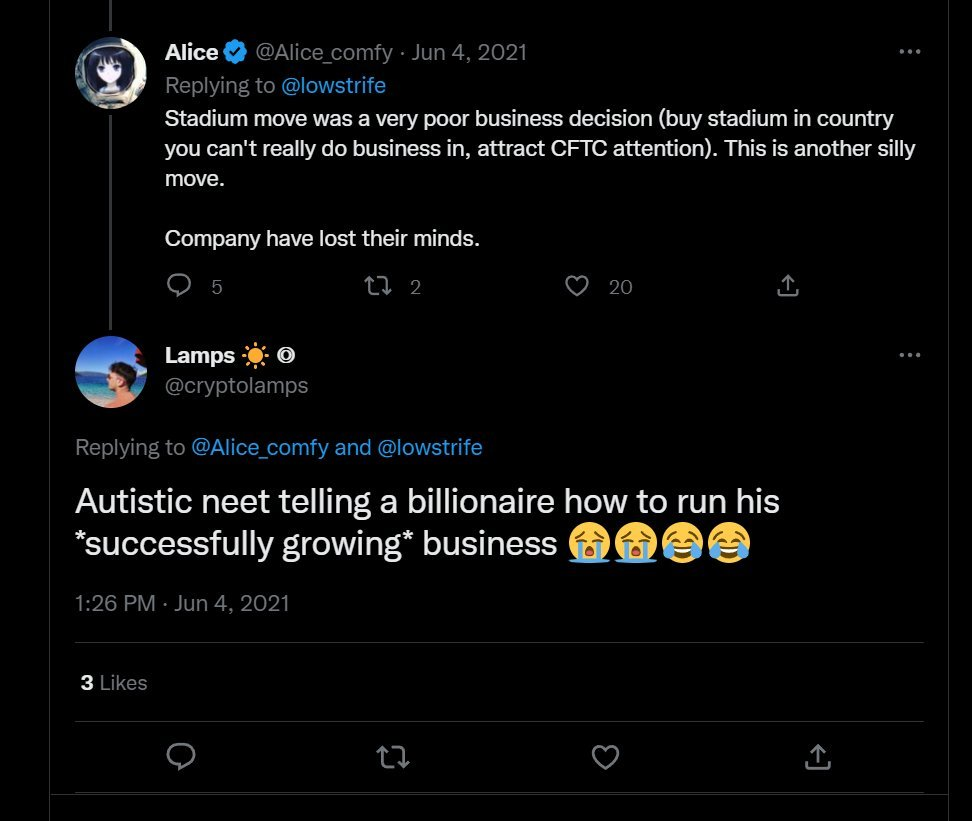

A classic interaction circa 2021. Still to this day one of my favorite ever twitter moments.

The TSM deal came after I was already out, but it was shockingly bad. They overpaid hugely, and clearly didn’t think the deal through (Riot Games had a restriction on crypto companies). The issue isn’t that they took customer funds to buy a stadium or TSM, but that this lack of logical thinking probably leads all the way down.

To Be Continued

My apologies if the writing here comes off a bit rough. I wrote this quickly as I want to have this out soon, there may be some grammatical errors.

This covers the history of my views on FTX & the company up until the recent actual insolvency. I will cover the recent breakdown and some theories in part 2.

One thing I will touch on is the Binance acquisition. I’m not as pessimistic as some are, I think CZ will honor the deal unless it turns out FTX is more insolvent than we currently know. Another loose end is what happens to Alameda, I assume they’re insolvent, but how much, and what about the tokens.

Leave a Reply