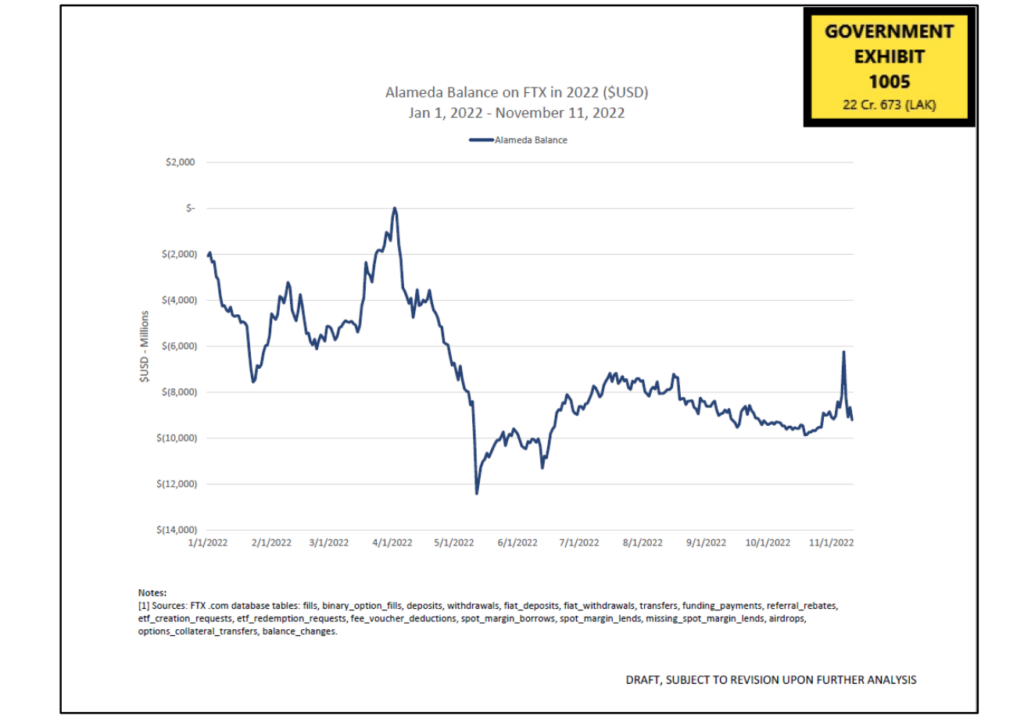

The US Government has recently dropped a new trove of files on SBF, and with this new information we finally have for the first time clear cut evidence and a timeline of Alameda’s borrowing.

One of my favorite ever pieces of crypto research was WizSec’s execellent coverage of the Mt Gox collapse, where thanks to on chain information they were able to uncover the timeline for Mt. Gox’s insolvency. In the case of FTX, that’s far more difficult due to the nature of derivatives exchanges, but thanks to this recent USG filing, we can get an idea of FTX’s deficit and how it evolved over time.

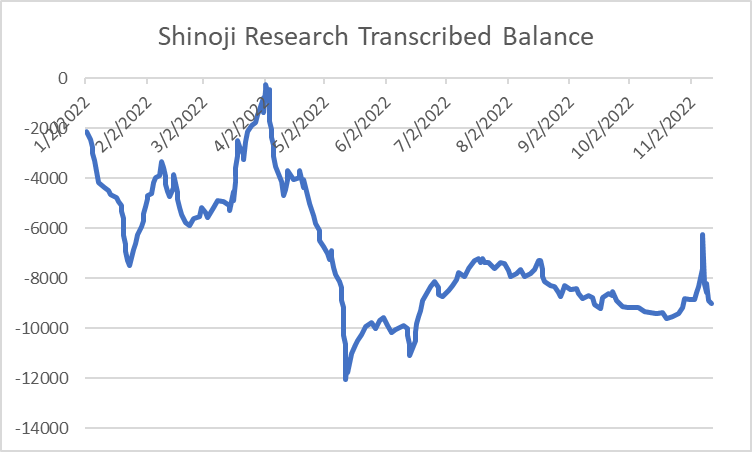

Alameda FTX balance CSV

Using web plot digitizer, I was able to extract ~ figures, which I will use below for more data analysis. Feel free to use for any purpose, I would appreciate an attribution to Shinoji Research.

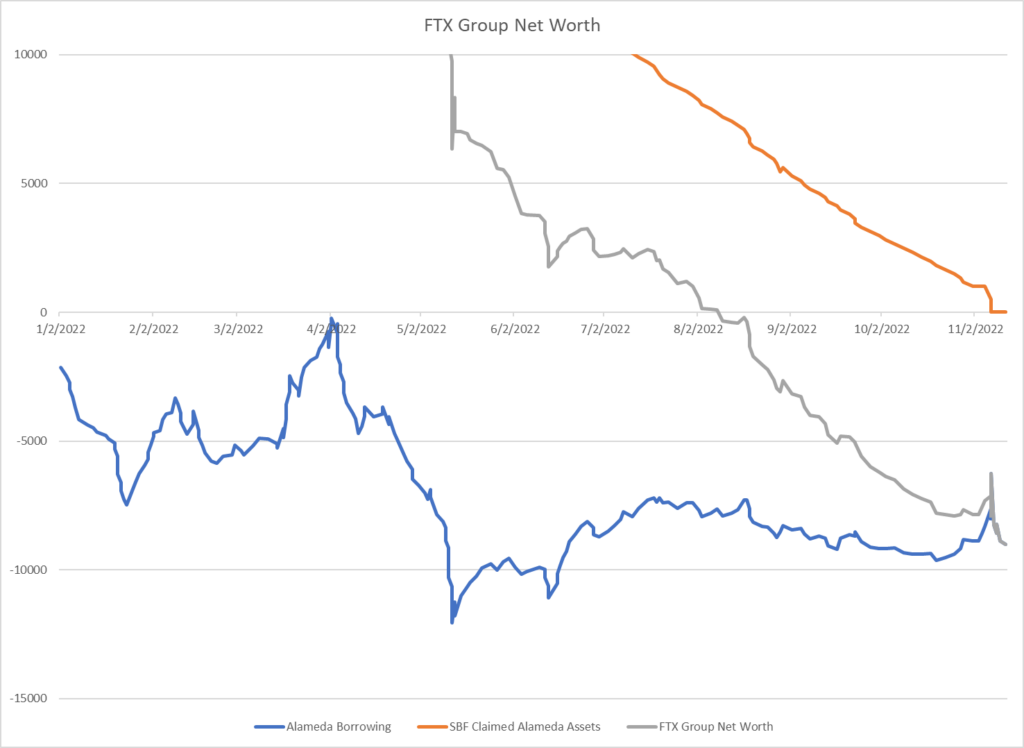

My chart for comparison, seems accurate enough.

Alameda Borrow Analysis

First of all it’s worth comparing this to SBF’s stated defense and timeline, and that this chart is specifically Alameda’s borrowing curve on FTX.com, it does not include any assets they may hold elsewhere that might partially balance the budget.

For the beginning of the year, Alameda is almost inversely borrowing to BTC price, implying an equity curve that was long BTC & correlated assets. When late April hits, we begin to see a divergence. A few users commented it seemed to be tied to Luna, but I don’t think that’s it.

Luna blew up on the 4th of May, Alameda’s borrowing had already almost doubled by then. On the other hand, Solana which Alameda is known to be a major investor in started to break, after a massive rally in April.

Following the collapse of Luna, Alameda borrows even more. I think we can safely rule out the theory that Alameda attacked Luna & profited hugely from the collapse. By May 12th, Alameda was over $12 billion in the hole on FTX, and this was before other lenders started to drop. From Sam’s official timeline, this is also near the point the FTX Alameda group became insolvent.

In June, SBF claimed Alameda was down to 14B and he ordered caroline to hedge, Alameda’s new borrowing was at $-12B on FTX, implying a total net value of $2b less any additional borrowing. FTX likely oscillated between solvent and insolvent throughout much of H2 2022.

What’s interesting is right around this date, Alameda’s FTX borrowing halves. I imagine the money was sourced from new crypto lender loans, along with some liquidations. I wonder if Sam also expressed some concern about the large borrowing then, which he isn’t admitting (because that would implicate him).

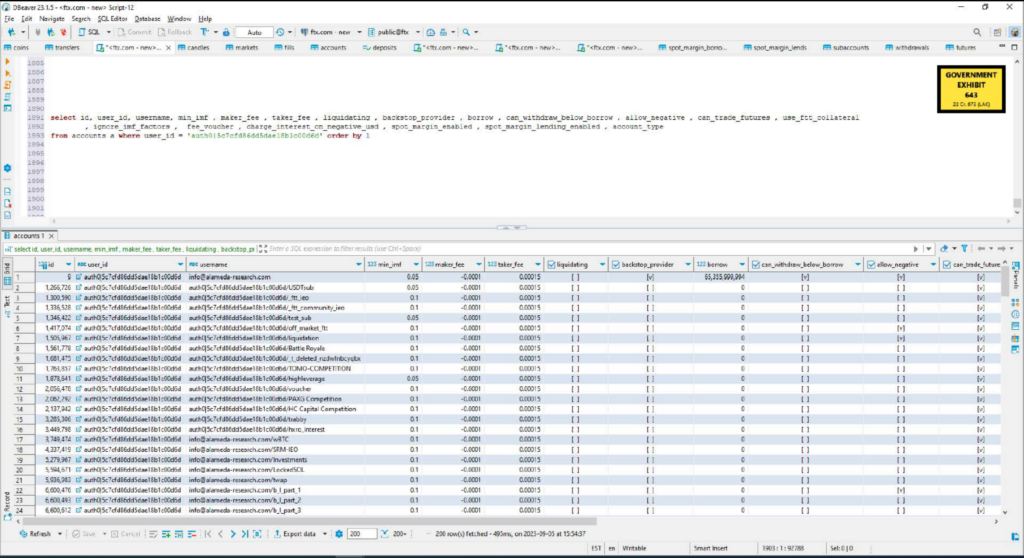

Fiat@ Debunked

What this story is fundamentally incompatible with is Sam’s Fiat@ story, where he claimed that FTX never offered Alameda a special line of credit and instead they just ended up with funds through fiat deposits. The oscillating balance rules that out.

In addition, the overview of accounts with negative balance and borrow ability shows it. The account fiat@(eitherFTX.com or Alameda-Research.com) never even shows up. Unless Sam is now going to claim that it wasn’t in the database, that fairytale is dead.

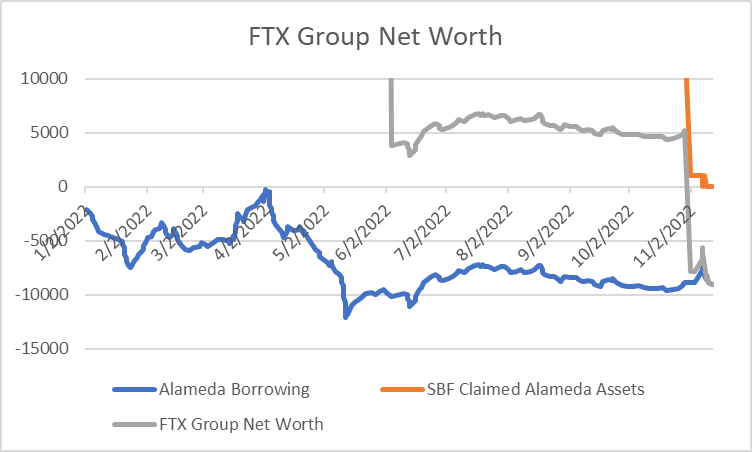

Plotting The Demise of FTX

Taking the numbers from Sam’s interview and plotting them, we get this graph. It’s messy, but provides an idea of FTX’s demise. I cut off values over +$10B as it’s irrelevant to our story.

Using Excel’s fill with series data tool, I can create this chart, which is quite satisfying. I could maybe slightly improve it by using % instead of linear decay, but it gets the point across. FTX likely was insolvent by August 2022 (incidentally when twitter user enchirdion22 noticed Sam say in a podcast FTX couldn’t survive if BTC stayed sub25k for long), and trended to 0.

Leave a Reply