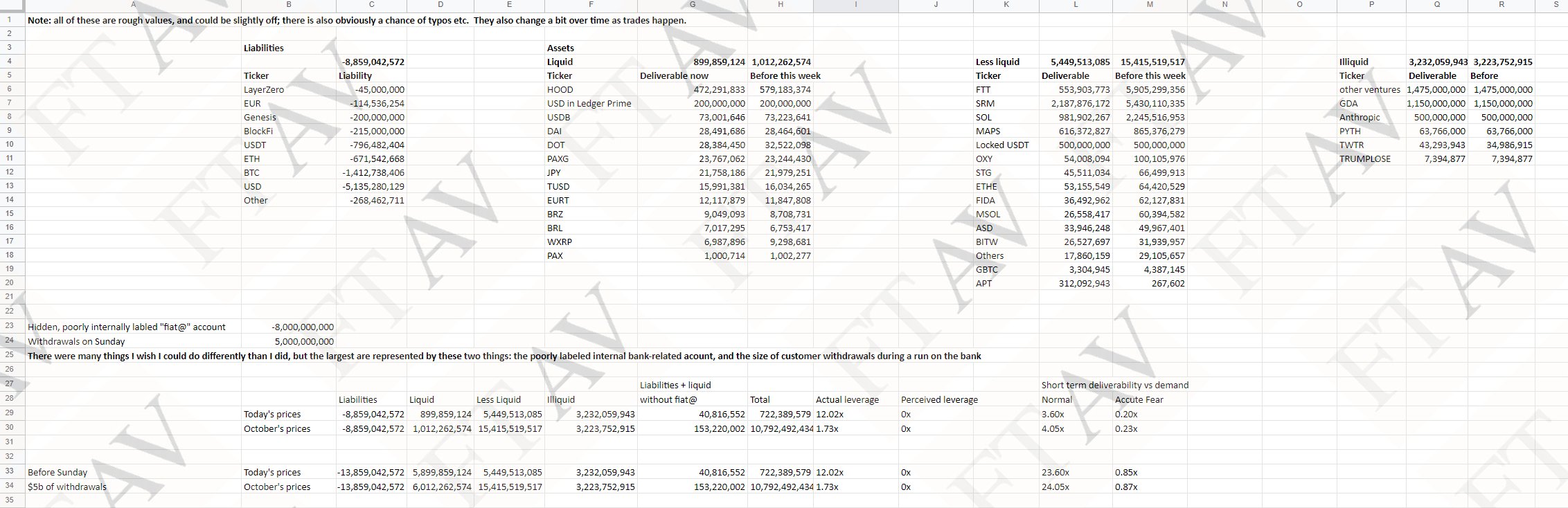

Recently FTX’s balance sheet as of late Thursday night (pre bankruptcy news & pre hack) has been leaked & circulated by the Financial Times. I’ve seen a few journalists produce estimates on the recoverable value of the balance sheet and thought I would try my hands, with some experience in the crypto trading space.

I typed out the sheet posted by the FT into my own sheet, not sure why my numbers are a bit off, either I made a small typo or FTX did (and weren’t using excel to sum the cells). Now I can begin to estimate real eventual recoverable value. I’ve seen some attempts at this, but most were using constants for every category which isn’t necessarily accurate. Now I’m going to add my estimates. One more caveat, this includes only FTX.com’s liabilities, not Alameda Research’s liabilities if their creditors are able to get between FTX creditors.

Now estimating the value of the various tokens, I looked at market cap & liquidity. For example Serum has about $300k liquidity to $0 on Binance, even if Alameda has every SRM in existence, they can only get $300k for it.

The assets they claimed to have on Friday are probably worth around $2b right now, but unfortunately they suffered a hack / inside job, with estimated losses around $500m. That leaves them with about $1.5B in assets against $8.8B in liabilities, in theory that would give creditors a recovery rate of $0.17 / $.

In addition to the hack, some funds were withdrawn using the Bahamian KYC method and there will be some legal fees related to the bankruptcy. Depending on how long it takes to work out, FTX customers are probably looking at 10 to 15 cents on the $, people who sold accounts for 20% got a very good deal.

The final thing that’s still unclear is whether anything will come of Justin Sun’s Tron deal that he promised customers. The withdrawals were supposed to go live on November 10th, and then crickets. A friend of mine tried the process and didn’t receive anything.

Maybe Tron holders might have some recourse against Justin Sun?

Leave a Reply