Why is a Tether worth ~1 USD, how are Tethers (or USDC tokens) actually created given few users work directly with them? That’s what I’m hoping to clarify in this piece inspired by one particularly misinformed twitter post.

Disclaimer: I have no employment, or business relationship with any stablecoin issuer, nor does any entity I own shares in. I personally avoid USDT (Tether) exposure beyond what is needed for trading USDT futures, and prefer USDC when available.

Tether is largest and also most infamous stablecoin, with a substantial community of skeptics, sometimes known as Tether Truthers. Critics believe Tether lacks reserves to back all outstanding tokens, which at least at times in the past has been proven to be true by the NYAG Report. I am not here to defend Tether, Circle, or Alameda Research, what I am intending to do is clarify how stablecoin creations / redemptions work with the goal of putting skeptics & supporters alike on the right track.

How stablecoin price discovery actually works?

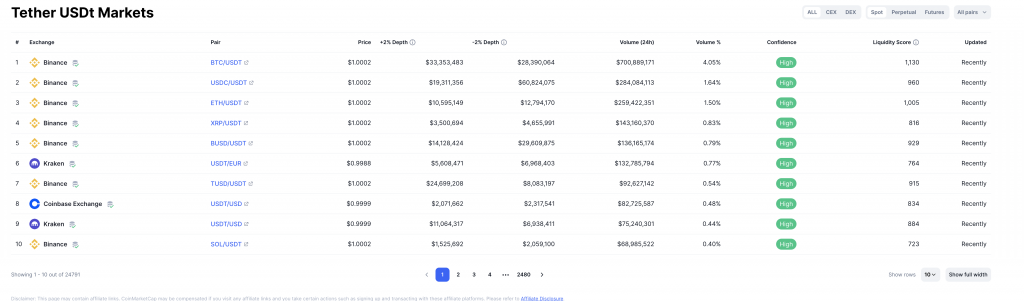

The biggest misconception I have seen online with regards to stablecoins is exchange stablecoin pairs (IE USDT/USDC) or stablecoin dollar pairs (IE USDT/USD). These pairs are largely irrelevant, the main way of determining the price of stablecoins, as most crypto aggregator sites do correctly is to compare the price of their most traded pairs against those coins elsewhere.

As shown in the above screenshot, the largest pair for Tether by far is Binance’s Bitcoin USDT pair, their is also a USDC pair of significant liquidity. The first fiat pair is further down on the Kraken exchange, the vast majority of stablecoin volume occurs on crypto-only exchanges.

It’s important when determining if a depeg or crisis is occurring to aggregate a number of popular exchanges rather than citing one specifically, especially if a fiat pair is involved. The most obvious situation is when an exchange is having banking issues, the price of stablecoins may go far above $1, but cannot be arbitraged down because the return of capital is uncertain. The weird inverse is on binance.us where USD deposits are disabled and withdrawals are allowed. Some naive users choose to sell their crypto for USD instead of withdraw, even at reduced prices.

You will notice in most cases inter-exchange prices should be almost identical, thanks to market making & arbitrage firms. When this isn’t the case, the reason is almost always in relation to the exchange, not the stablecoin. You can do a simple sanity check by checking the price of Bitcoin USD against other exchanges to make sure you don’t have an exchange problem.

Alameda’s 36 Billion Explained

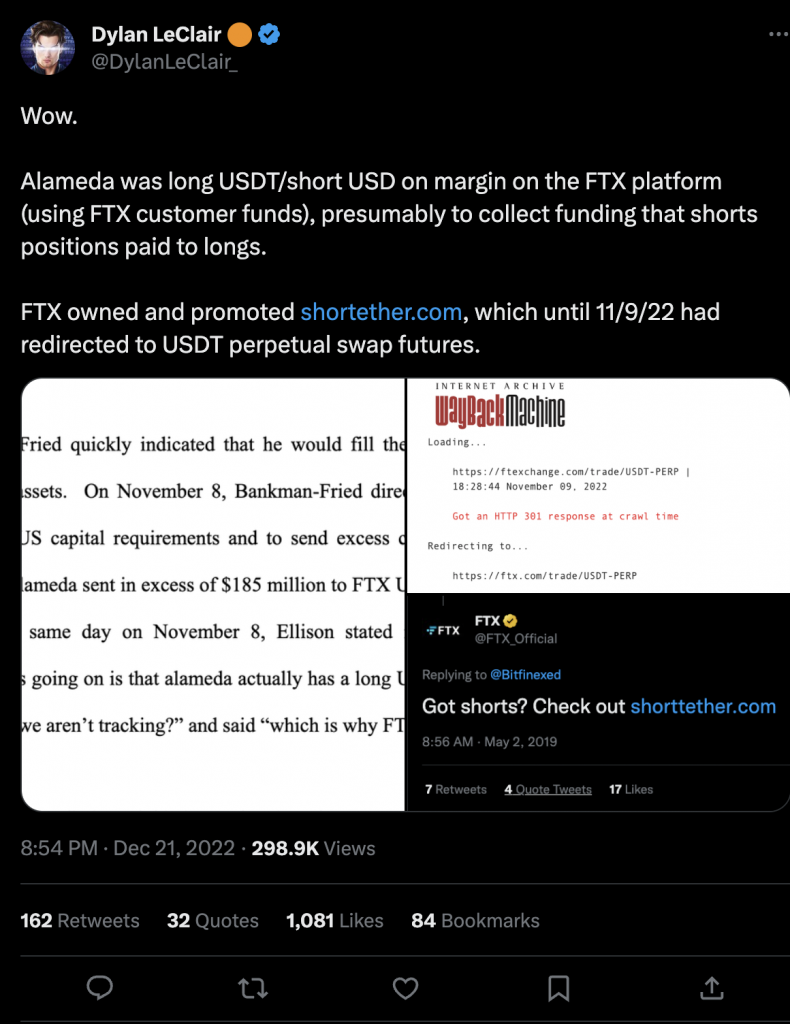

It’s been widely cited from Protos’s Brilliant insight tracking down Tether Flows that Alameda Research received over $36 billion from Tether. Alameda’s Tether needs come from two facets, as laid out in that article, 86% of their Tethers were sent directly to FTX, it’s possible this figure is overestimated due to commingling between entities. The remaining Tethers were primarily sent to Binance & Huobi.

I’ll explain the arbitrage part in a moment, but first what was FTX.com doing with billions of Tether? FTX had an interesting quirk with stablecoins, for those of you who remember all non Tether stablecoins were actually just “usd” and converted to USD on deposit in the backend. I imagine they did this as a security measure given it is now known FTX lacked cold wallets, they used their Silvergate bank account as a quasi-cold wallet. The back & forth also has a benefit of making it impossible to determine their solvency on chain, yay for no transparency.

The arbitrage process

Collateralized stablecoins lack the fixed supply or supply schedule of most cryptocoins and instead are freely convertible between their base asset & token. You can easily sell large quantities on exchanges at any given moment because market makers can easily buy & sell. Until recently the process was near-instant for most stablecoins through Silvergate SEN or SIGNET (largely regarded as inferior).

Following the seizure & collapse of Signature Bank, the closure of Silvergate Bank, and the collapse of Silicon Valley bank, USDC briefly depegged as users worried that billions in liquidity may be missing. Here we can see what happens when the free convertibility breaks, market makers have exposure limits & cannot refresh their cash via redemptions.

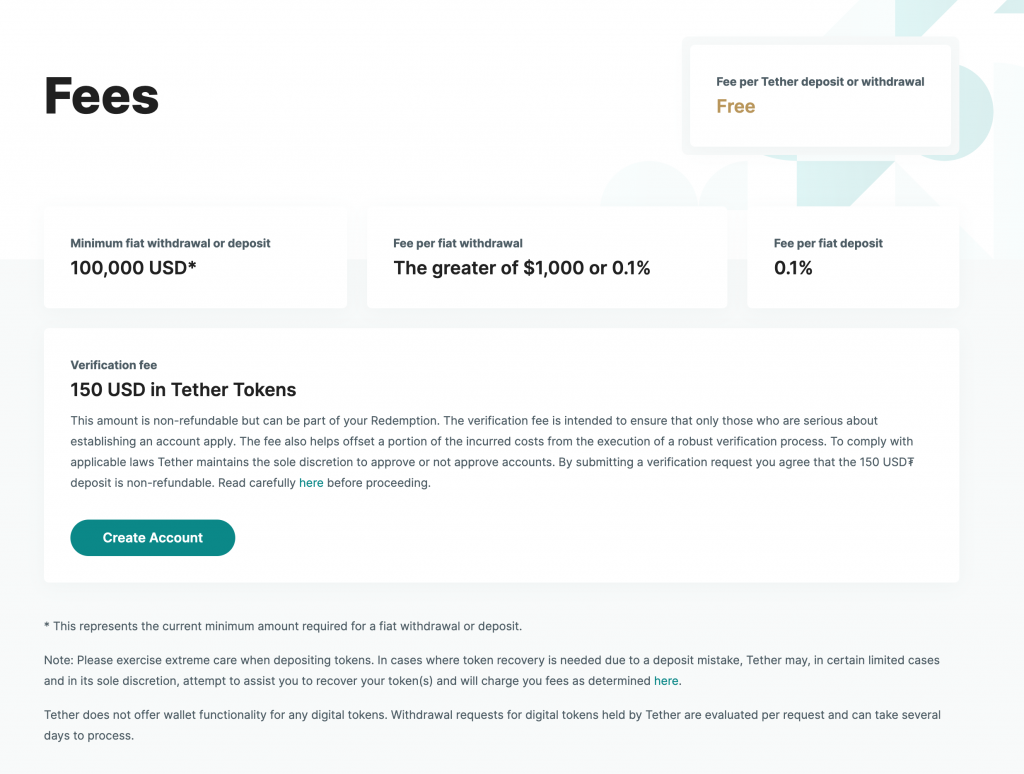

Tether has a much more opaque redemption / creation process than other ‘regulated’ stablecoins. In addition, tether has had a far more checkered past with banking relations leading to various de-pegs over the years, followed by a return to $1 when redemptions are restored.

For years Tether maintained an invite only club for deposits / withdrawals and continues to maintain an excessive minimum, while USDC allows anyone with a coinbase account to redeem & create at will. Almost all Tether’s are bought & sold on exchanges, while a few firms keep the peg at 1, during extreme market movements the price can deviate a bit as traders rush for the exits. I personally remember shorting Tether at $1.03 on March 12th 2020.

“If I Did It” – How Fraudulent Stablecoins would operate

Disclaimer: This section is entirely hypothetical, I am not accusing any firms of using any of these techniques, the goal is simply to explain what would work & what wouldn’t.

I recall IFinex (parent of BitFinex & Tether) CTO & Spokesperson Paulo explaining once the idea that they print Tethers to manipulate the market is silly because they have the USD & could use that. He’s not wrong, after reading the previous section you should be able to understand why printing unbacked Tethers would not work. At best they’d end up with the price below par and a quick collapse as market makers would try to arbitrage, only to find out that withdrawals were disabled. When withdrawals have issues it’s hard to keep the peg without a sudden issuance, the idea they could issue billions of USDT into the market with no backing is silly.

On the other hand, simply letting the market dictate the supply of your stablecoin and misappropriating a portion of the reserves is a much safer approach. The fractional reserve wouldn’t become known unless withdrawal demand exceeded all available reserves, the coin would trade at roughly $1 until all reserves were exhausted, at which point it would rapidly approach 0. This exact scenario is mentioned in the NYAG settlement and appears to have happened after BitFinex realized Crypto Capital was dead.

I will point out it is also safe & possible for stablecoins to inflate their marketcap by using their reserves to create additional coins. As long as those coins never hit the market, it wouldn’t cause issues although you would now have a stablecoin backed by itself.

A troubled stablecoin can potentially benefit from doubts by buying discounted coins in the secondary market rather than redeeming for $1. For the same reason, it’s unlikely Tether is selling Tethers below $1 to OTC customers (a discount probably refers to the 0.1% fee).

The Print & Swap method

Now lets get into some profoundly dumb ideas, such as printing unbacked Tethers, selling them for backed USDC and redeeming. I’d hope most readers have caught on by now as to why this isn’t going to work.

Depending on how the operation was structured, Tether tokens would start to decrease in value, and USDC would trade slightly above par. The problem comes in when market makers notice this fact and start creating USDC & redeeming Tether, if the Tether side of that transaction fails, the price would rapidly crash (think terra luna). If Tether was redeeming as usual, nothing would happen, they would just pay a bunch of fees for no economic effect.

The most outrageous of all idea is that USDC’s decline in market cap could be attributed or would be expected by this kind of operation. In reality the market cap of USDC would remain stable, because the increase in buying demand for USDC would lead to more issuance.

So what happened?

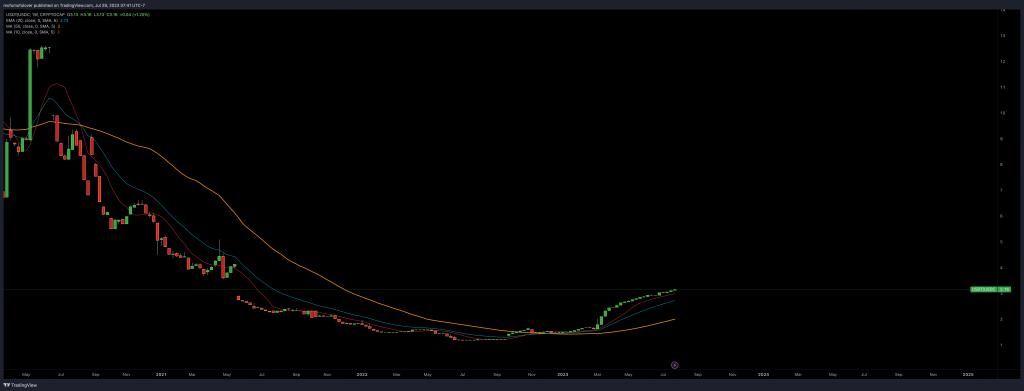

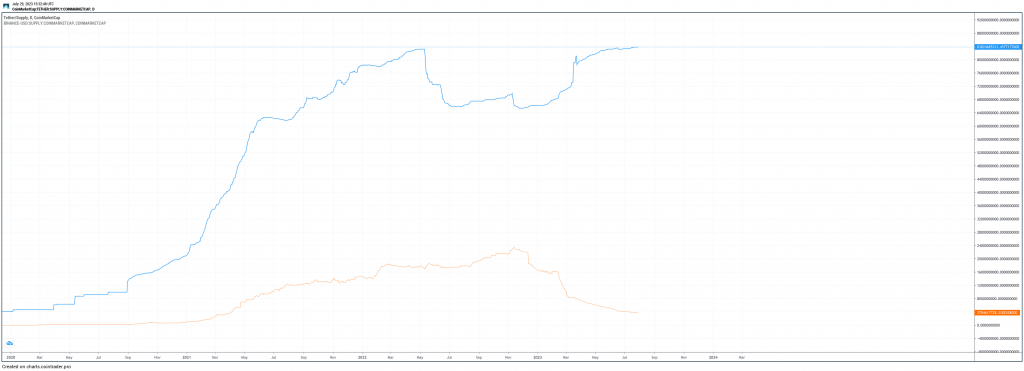

Why has USDC fallen while USDT has gained, reversing a long term secular trend in favor of USDC? I’d imagine there are a few factors at play, the most concrete in Tether’s favor is the demise of another stablecoin, BUSD. It’s helpful to think of the usecase rather than simply the token. USDC is used heavily by DEXes in DEFI, while USDT is the token of choice for most crypto only centralized exchanges.

The largest crypto trading exchange, binance had partnered with Paxos to create a custom Binance branded stablecoin. Binance also went on to heavily incentivize the usage of said coin, largely at the expense of tether. After BUSD received a cease and desist from regulators, new coins can no longer be issued and most have gradually been redeemed. Much of that capital returns to Tether.

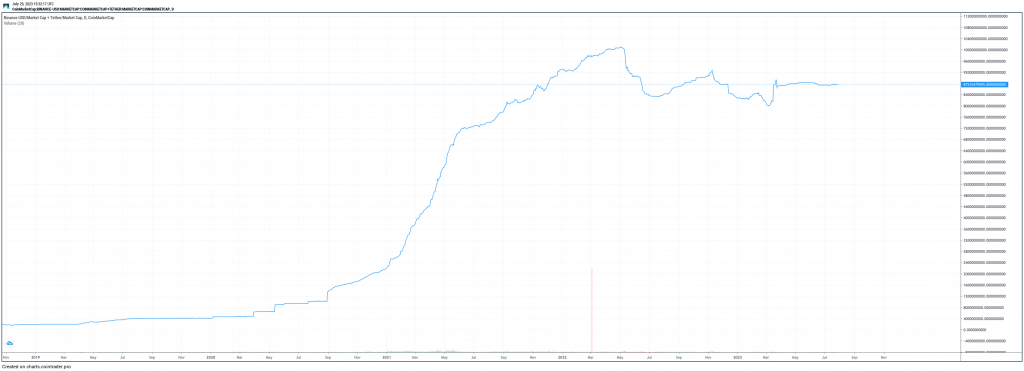

An interesting comparison of Total Binance USD + Tether market cap & both of them individually. Initially Binance USD saw some organic adoption as the ecosystem for stablecoins grew and then you can see a spike on BUSD & dip on Tether when binance started allowing free conversions. Coinbase & Circle also ran a similar marketing campaign at the time, encouraging users to redeem their Tether for the safer and regulated choice.

The final piece of the puzzle is what caused the sharp and dramatic drop in USDC market cap? Is it a general decline in the crypto / stablecoin market, or something else? The answer is after an initial depeg during the Silicon Valley crisis, people redeemed in mass and many never came back, possibly either switching to Tether or leaving the ecosystem outright.

Leave a Reply