As one of FTX 1.0’s first users, my thoughts on a potential restart.

FTX died nearly 200 days ago and since almost day 1, one of the suggestions to make creditors whole has been a restart of the exchange, often with a BitFinex style recovery token. In this article I aim to investigate the viability of such an outcome, and whether it is favorable to creditors.

In the months since I’d previously written about FTX’s collapse, the prognosis for creditors has improved, market rates for claims are now far above my initial estimate for creditor recovery. Claim buyers are in the game to make a profit, and probably anticipate a much higher recovery (50-80%).

The idea of relaunching has existed from pretty much day one, and was even endorsed by Sam Bankman-Fried himself.

Since S&C pressured FTX into Chapter 11 filings, however, I worry that those pathways may have been abandoned. Even now, I believe that if FTX International were to reboot, there would be a real possibility of customers being made substantially whole. And, further, I believe that all customers with purely spot trading activity should, and easily could, be made fully whole, with assets already on hand.

Sam Bankman Fried https://sambf.substack.com/p/ftx-pre-mortem-overview

With the intro out of the way, it’s time to examine history to see whether this is a serious prospect, or a serious waste of money.

World Exchange Services (BTC-E)

There are a few comparisons that can be drawn to FTX, the most frequently cited one is the BitFinex hack from 2016, I believe a more comparable example is WEX. I doubt many readers will remember BTC-E, a Russian exchange that was seized by law enforcement back in the midst of the 2017 bull market. After this setback, they were able to recover their cryptocurrency wallets (but not their fiat) and relaunch.

BTC-E was a notoriously lax AML exchange heavily used by criminals, it was also recommended by Dread Pirate Roberts to a prospective hitman as a safe way to cash out Bitcoins. The platform did not ask for any personal information and was a key piece of infrastructure for the crypto underworld.

BTC-e also proves that their is honor among some thieves, after the initial seizure the FBI only obtained their bank accounts, but not any crypto wallets so they were able to return the funds & relaunch after a brief delay. They migrated from .com domains to .nz and chose the name WEX (world exchange service) for the new brand, which unlike it’s predecessor did at least pretend to care about KYC.

WEX. Start.

15.09.17 12:29 by admin

Dear users!

The WEX portal team is glad to welcome you to our platform!

This is our first official news release!

We thank ex-BTC-E users for their patience. For our part, we spent a lot of effort and energy to create a new trading platform in the shortest possible time. Our platform will conduct its activities in accordance with AML / KYC laws and world practices in this area. You can find them here https://wex.nz/page/1We would like to express special gratitude to the btc-e technical team for their professional assistance in migrating digital user profiles and data, and separately note that our company did not in any way come into contact with or take over the funds of BTC-E Always Efficient LLP.

Information and explanations of the general plan will regularly appear in the news portal. Each individual case is considered through the support service and we answer private / confidential questions through a personal account.

Here we will try to answer the most popular questions and add updates regularly, because the platform is rapidly developing and new features and services are being added.

In addition to the transferred balances, each user is credited with bonus crypto-tokens at the rate of 61.79/38.21 (%), information on which is available at https://wex.nz/tokens , the tokens will be available for trading and for use via wex-code.

For general security, the site will work in test mode, in order to check the operation of all blocks, daily limits will be set for withdrawing funds (information about them is available in your account profile), in the future they will be increased. The test period will last from 3 to 7 business days. At the end of this period, the site will work without restrictions, we hope for your understanding.

A cooperation agreement has been signed with a network of verified exchange services (agents), which will allow you to deposit and withdraw USD/EUR/RUR with minimal commissions, in a convenient way for you and in different parts of the world.

List of official partners working with us today:

https://www.advcash.com/

https://perfectmoney.is/

https://100monet.pro/List of WEX-code input-output options available through a network of agents/partners:

Webmoney

Yandex money

Qiwi

Amounts over 10,000 USD, as well as Sepa/Swift from 20,000 USD, you can withdraw using the VIP section

https://wex.kayako.comBanks:

Sberbank

Alfa-Bank

Tinkov

Privat24about 20 exchangers in the verification process

application here ( https://wex.kayako.com/en/conversation/new/33 ).Due to numerous requests from customers, a VIP section has appeared for trading large volumes of cryptocurrencies. If you want to deposit/withdraw more than 100k USD, write to us https://wex.kayako.comand your manager will tell you about the best conditions on the market. The exchange will act as a guarantor of the transaction, an automatic escrow service will be available in the near future.

Vacancies

In connection with the development of our platform, related projects, as well as we regularly receive requests from partners to develop IT solutions on the blockchain. Therefore, if you are a specialist and professional in this area, we will be glad to see you in our team. You can submit your resume and cover letter here https://wex.kayako.com/en/conversation/new/34 .At the moment, active work is underway to develop these areas: investments, trading, arbitrage, consultations, mining, ico, exposure of pyramids. Follow the news on our website in these areas. We are always open to cooperation and if you can offer us a partnership or advise professionals from these areas, we will be happy to hear from you.

We believe that blockchain will change the future, become an alternative to the existing corrupt financial system and unite people around good economic goals.Thank you for believing in us. Thanks for being with us.

Sincerely, WEX Team

WEX TEAM, archived November 2018https://web.archive.org/web/20180725001930/https://wex.nz/news/1

This post originally published in September announced a new dawn for the WEX / BTC-E platform which was functionally equivalent to it’s predecessor, but claimed to be under different management.

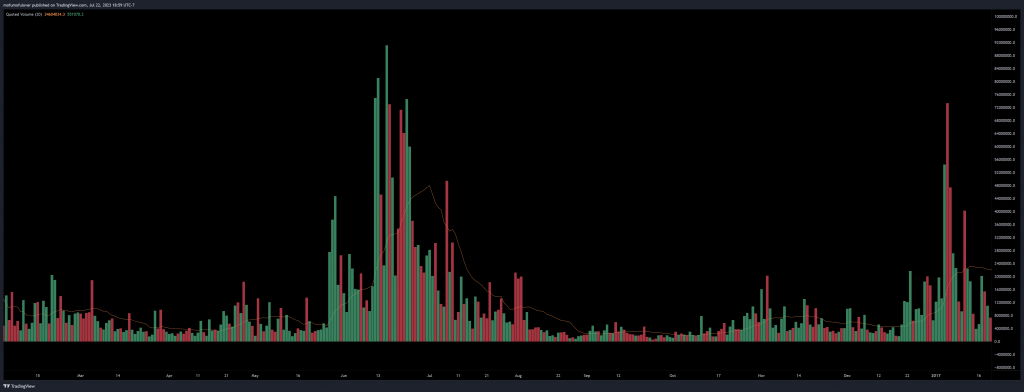

Chart of WEX from Bitcoin Wisdom, unfortunately not much historical data.

Tradingview has long since delisted WEX & BTC-E, but from the homepage on web archive we can get an idea of the relative popularity of each. In December 29th 2017, WEX traded 2700 BTC, or 26,088,625 USD, this is a few months after the platform launched. Comparatively for a normal day on BTC-E near the closure it was trading 6,400 BTC or 14,346,851 USD. For another comparison, the Kraken exchange traded 530% more USD volume on December 29th than it did on June 1st. If we assume that had BTC-e continued it would have grown proportionally to kraken, it would have traded over $90m, implying a 70% loss due to the relaunch, but still substantial volume.

So what happened to WEX, the relaunch was a success, but at some point depending on which story you believe, either the admin decided to exit scam, or was tricked by fake FSB agents. The platform was eventually sold to a Donbetsk separatist who was later arrested for fraud, I’ve always found it curious that a platform that relaunched to avoid screwing their customers would then exit scam a few months later.

Result: -70% Volume

BitFinex Hack

The most famous exchange hack & relaunch was the BitFinex hack of 2016, BitFinex enjoyed a few advantages for their survival that FTX doesn’t, but it’s still worth comparing given the damage done to Finex’s credibility.

BitFinex was hacked for 119,756 bitcoins on August 3rd, 2016. The exchange immediately locked down withdrawals & halted trading until August 10th. In the immediate aftermath the exchange relaunched with almost 70% less volume, but as the months went on it recovered. 6 months later in January 2017, Bitfinex would trade a new USD high in volume, by September of that year they finally traded more BTC than they had pre hack. The relative number is somewhere in the middle, but in the short term BitFinex lost 70-80% of it’s volume.

By April 3rd, 2017 BitFinex was able to buy back all BFX tokens, and the platform still lives on to this day. The issue I take with this comparison is two factor.

BitFinex enjoyed two key advantages

- BitFinex was only down for a week, 7 days later they immediately haircut accounts by 36% and restarted trading. For contrast FTX has been dead for almost a year, relaunch timeline would likely be after the 1 year mark. Many FTX creditors have either found a new home exchange or moved on from crypto altogether. Some have tragically died.

- BitFinex was the only serious margin trading platform for years, as notorious BFX critic “Bitfinexed” would point out when asked why people would still use the platform despite all of the concerns. BitFinex had the best and most liquid crypto margin platform for years, only really losing place to BitMEX later in 2017. In contrast FTX is dominated by Binance and ByBit is happily taking second place, while FTX did offer some unique features (portfolio margin), much of it’s early first mover advantages were copied by competitors.

The ultimate conclusion is similar to wex initially with a 70% loss in volume, but BitFinex also shows that at least when you have a significant product advantage, you can rebuild trust and build back the exchange.

Was FTX really profitable?

Historical analysis predicts a decline of 70% relative volume as the norm for exchange reboots. I can easily make a case for FTX to be in a far worse situation, but from the other side, looking at the derivatives CEX market being able to trade as much volume as BitGET doesn’t seem unreasonable.

When discussing the FTX reboot the first thing we need to be clear of is was FTX 1.0 really a profitable independent business from the bankrupt alameda research.

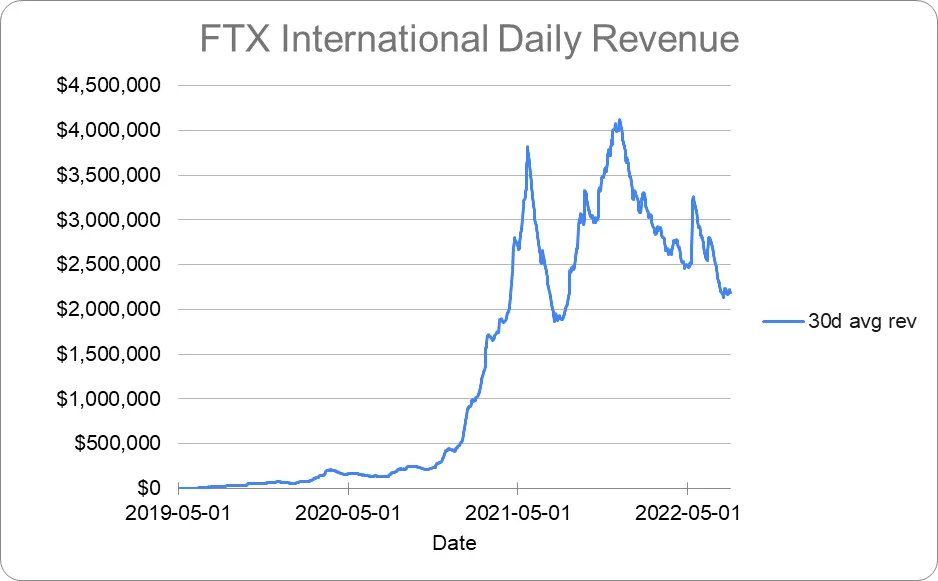

FTX Daily Revenue – https://sambf.substack.com/p/ftx-pre-mortem-overview

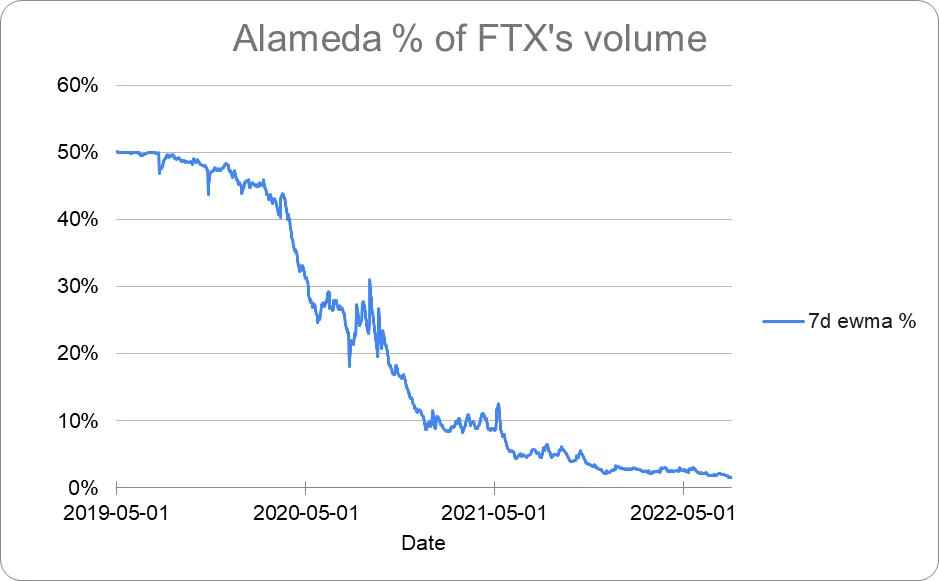

Alameda research’s volume market share, given alameda is usually on the market maker side you can double this for their MM share.

These two charts tell much of the story from SBF’s side of FTX. Also taking into account John Wray’s redo of FTX’s accounts there are some interesting stories here. Firstly anyone with cursory knowledge of finance understands that revenue is just one part of the picture. Similarly while it seems like Alameda was irrelevant by the demise of FTX, ~4% is still a large market share on a major exchange (as a random comparison, on OPNX I was able to achieve 5% while there was very little trading), especially if most of those fills are of ‘last resort’. Anecdotally in many cases where Alameda received a favorable fill (wicks and what not) against users on FTX they would refund that to the user.

It’s also interesting that Alameda’s share declined followed FTX’s growth until April 2021, when the exchange peaked, but as time went on Alameda’s share continued to fall. This may mark the spot when outside market making became a significant part of FTX, it could also mark where Alameda started getting front ran.

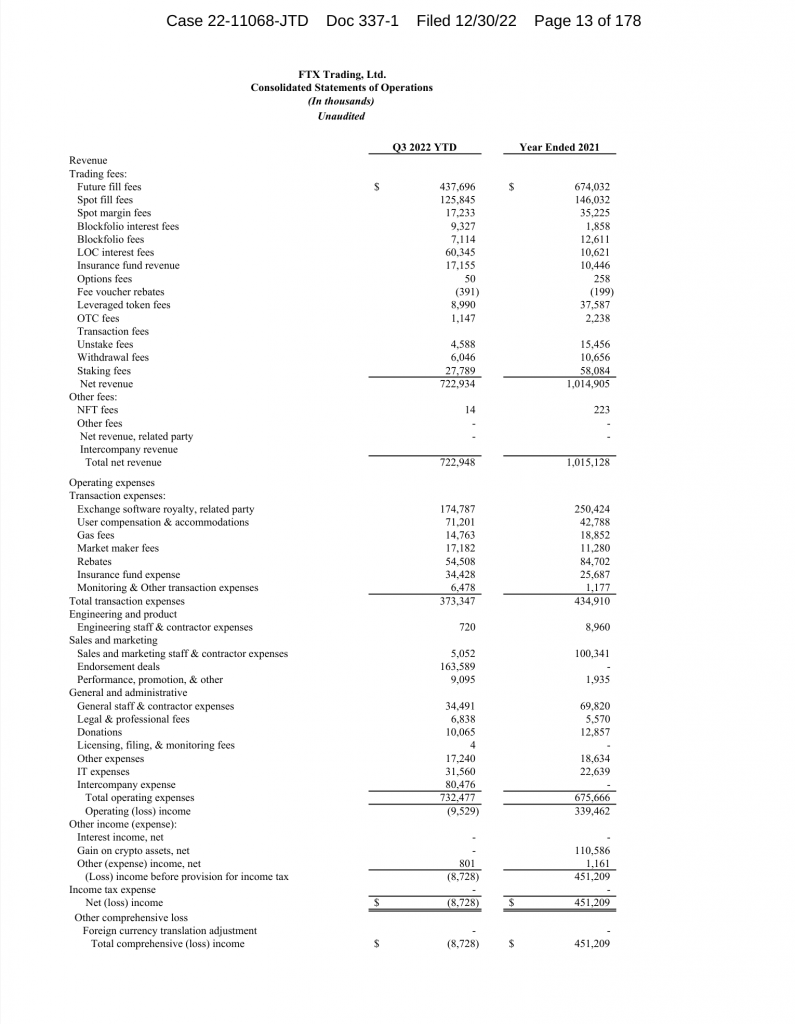

The “Consolidated statement of operations” here shows a couple of interesting points, you can view the full PDF here (note: this is a very long document, the accounting is exhibit E): https://restructuring.ra.kroll.com/FTX/Home-DownloadPDF?id1=MTQzNTg4NA==&id2=-1.

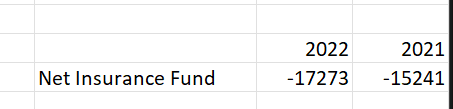

The most interesting I immediately noticed the first time I looked at this sheet is the insurance fund. Either they had a huge surplus from 2019 &2020 or the account ran a perpetual deficit. One of the red flags I noticed back when FTX was alive was that the insurance fund page was just a placeholder, the reason is now obvious, the fund never existed, they simply took the money from the P&L to cover the losses. FTX’s generous liquidation engine was in fact failing to deliver adequately.

Despite the insurance fund deficit, the company could still be considered profitable, I imagine they simply left it as is because it was a selling feature for the exchange, either that or they were so incompetent they didn’t notice (these accounts were compiled by the bankruptcy team after the fact).

It’s also noticeable the huge YOY growth of LOC interest fees, much of that could be down to the rise in FED Funds rate, unfortunately we cannot estimate how much customer money they lent and collected interest on without knowing the rate charged. I’d imagine at the low end it’s 2%, the same rate charged for very high quality mortgages, realistically it should be far higher for 2021 giving an upper limit of $500m. Depending on how much interest rates rose in 2022, it’s possible that the LOC balance was as large as $2b near the death of FTX.

The other rapidly growing & concerning part of the income statement is the “User compensation & accommodations line”. Back in 2019 when Alameda’s MM had an outage many users were refunded the losses, FTX has done this many times, and it can essentially be seen as losses due to incompetence. In 3 quarters of 2022, $70m was paid out (almost 10% of revenue).

Zooming in here we find more oddities, engineering expenses apparently fell more than 90%, given the state of the product I can almost believe that, but what happened here. Another oddity is marketing staff / contractor expenses falling from a staggering $100m, and a surge in endorsement deals, I have to wonder if they were counting most of 2021’s endorsement deals as contractors?

Moving past all of the oddities, and errors we do still end up with a profitable exchange in 2021 (330m excluding the crypto gains), and a small loss in 2022. If we were to strip out the wasteful marketing spend FTX could have achieved over $100m in profit for 2022, and $400m for 2021. Often compared Coinbase for reference achieved $3.1B profit in 2021 & a 2.62B loss in 2022, FTX is a smaller but also far leaner operation.

As we did for previous relaunch studies it’s now worth comparing the volume of major exchanges vs 2022, this time bitcoin hasn’t moved much in price and neither has volume. Kraken & Binance are both seeing similar levels of trading they did prior to FTX’s collapse, so the general market is unlikely to effect the success.

One of the largest expenses is labeled as “Exchange Software Royalty – Related Party”, it is almost exactly 25% of exchange fees, it’s not clear whether this is a tax evasion scheme or actual costs of the software development (the engineering staff spend is very low, especially in 2022). Assuming this ‘royalty’ is not essential then the real profitability of FTX is much greater than previously estimated, a net profit of $650m in 2021 and $370m in 2022 without marketing spend. Taking these figures it’s now possible to estimate the income & revenue of FTX 2.0 under various scenarios.

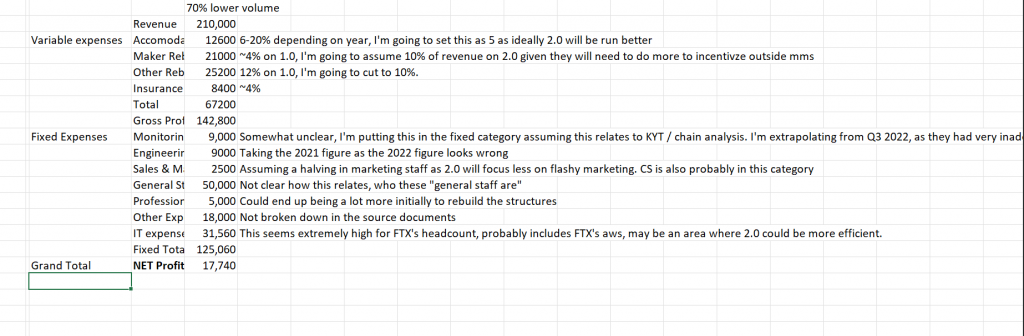

My reference scenario is that FTX 2.0 trades 70% less volume than FTX 1.0 and the fee structures remain the same, I am also assuming that 2.0 doesn’t initially fix the insurance fund. Even with this fairly conservative central estimate FTX 2.0 would turn a moderate profit, the biggest unknown is the startup fees, to re-analyze the code, relaunch the tech & relaunch corporate structures. I’ve taken the costs from the original document & tried to assign either a percentage of fixed cost depending on the facts.

| Scenario | Revenue | Net Profit |

| Failure Scenario (90%-100% less volume) | 67,500 | -79,500 |

| Central Estimate (70% Less Volume) | 210,000 | 17,740 |

| Optimistic Recovery (50% less volume) | 350,000 | 112,940 |

Trying a few scenarios, most optimistically that FTX 2.0 trades half the volume of 1.0 and worst case 90-100% less, 2.0 looks to be a profitable venture in most case, but unlikely to make a large impact on creditor recovery from the business alone. The logistics of the relaunch may prove challenging, they could potentially launch as wex did with an initial credit to user balances and a percentage in a token, or in FTX 2.0 stock (slowly repaid by user fees).

The saving grace could come from VCs & investors, as I mentioned earlier in the article, FTX’s balance sheet hole is shrinking, and the new business will attract some speculative attention. I’ve seen many comparisons to COIN stock, many focusing on the profitability, but I think the more relevant one is the price to sales ratio. Coinbase is currently trading around 8x trailing sales, it has generally traded around 4.5 and I imagine it will revert to that range eventually (or sales will catch up). Under the central scenario, FTX could be worth almost $1 billion (945m USD), current management claims to have recovered $7b of liquid assets and is sitting on the Anthropic AI investment which is certain to sell for more than it was purchased for ($500m, likely worth $1.1B now).

The end result is that FTX can probably make customers whole for less than $1b, making the 2.0 investment an attractive way to finish off the recovery. I went into this skeptical, but after running the numbers, I have to agree that FTX 2.0 is probably the best solution to the disaster that was FTX 1.0.

Would you use FTX 2.0, please let me know in the comments. The next post on here, barring any breaking news should be the question I get the most, what I think / have experienced in the early days of OPNX.

Leave a Reply