This is a book I first heard of from Protos’ reporting on A16z’s sketchy behavior regarding the ‘bestseller’ status of this book. I decided to see what the alleged bestseller is actually made of and read it.

This is not really a book review so much as commentary on the ideas expressed in the book. I think the book presents a good historical summary of the internet, and a hypothetical explanation of a crypto future. I am often asked to explain my crypto-skepticism in a longform format, I believe i can kill 2 birds with one stone here.

I will preface this by saying I am extremely skeptical of ‘blockchain technology’ and the idea it will ever be mass adopted. On the other hand, I largely agree with the authors points regarding ownership as opposed to centralized platforms (hence why this is shinoji-research.com as opposed to shinoji-research.substack.com).

The Internet Trilogy

Web 1.0 worked mostly in the same manner as what you’re currently reading, you read the content on this page. Websites were static, contained information and some limited graphics (bandwidth was limited to 56k for most users).

Web 2.0 is the idea of centralized (referred to as corporate) platforms centered around UGC (user generated content). X (Twitter), FaceBook and Reddit are all popular examples of Web 2.0, an unfortunate side effect of such a setup is you lose the individual freedom & control.

This can manifest in censorship, or lack of interopability. In the post-generative AI world, many social media companies have hyperinflated the prices for their API’s in the interest of charging extortionate fees to AI firms.

The Ownership Era

It’s a common talking point, whenever pitching any vision to begin with the past, and then venture into the present & a vision of the future. In Chris Dixon’s “Read Write Own”, this is owning your content, NFT style.

We begin with an explanation of “blockchain technology”, which as the author proves has devolved into a buzzword, loosely related to the concept of a Blockchain (IE Bitcoin’s UTXO Blockchain). I will assume the author belongs to the school of programmers who’s experience with a database is running migrations through an ORM, rather than a deep understanding of databases.

An important aspect of blockchains, is to use storage terminology, they are akin to a mass RAID 1, rather than any sort of distributed computing (I am aware there are a few exceptions). Some achieve moderately high throughput by only using a small subset of delegated validators (IE Solana), others will instead allow anyone to run a validator, at the cost of very low throughput and theoretical offchain scaling (IE Bitcoin, Ethereum in practice as of 2024).

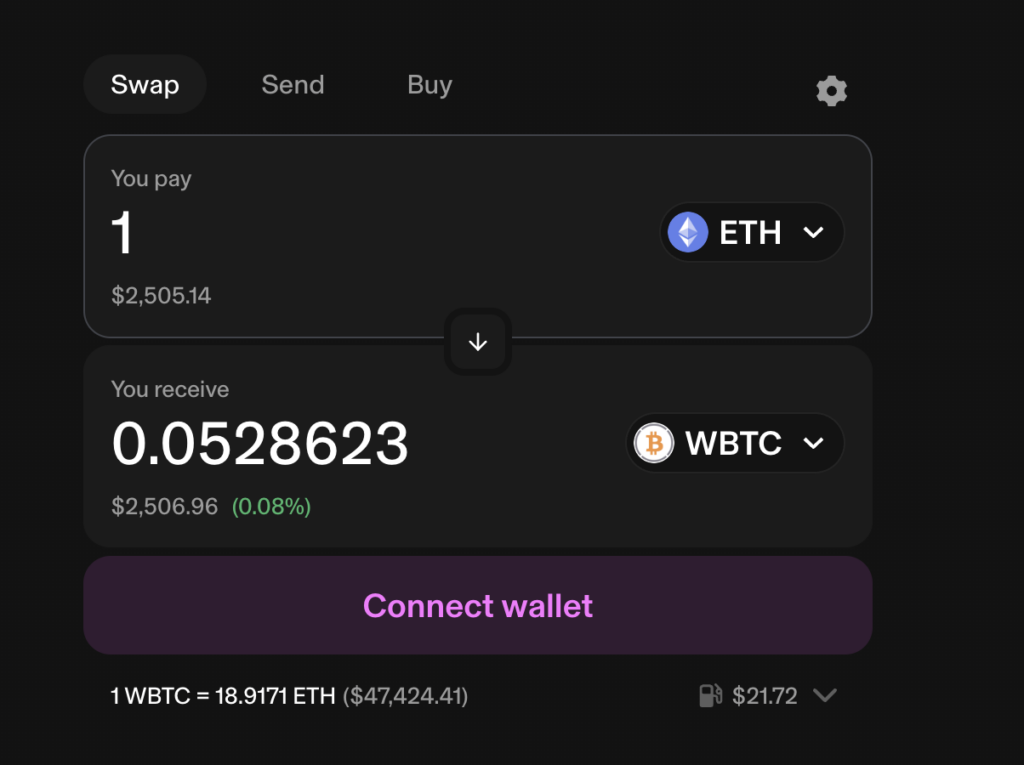

On the idea of Blockchains, or Ethereum being a computer, I will link to this post on Stack Overflow. Very little computing can take place under this kind of model, in practice (much like a database), you have a webapp (called the frontend usually), and the backend is a fairly simple program.

You probably think of this as Uniswap, but most of this is actually just running the browser. The part that runs on the Ethereum blockchain can be read here: https://github.com/Uniswap/v2-core.

One mans Trash is another’s treasure

The author actually goes on to explain how many perceived downsides of the blockchain can actually be upside, such as constraints on future behavior. This is a double edged sword.

Immutability is a good defense against a malicious author, and ‘enshittification’, but there’s a problem. The author believes corporate databreaches are an indication of the fundamental flaw of ‘corporate networks’ and their securitiy structure. I believe this is incorrect, security breaches are largely a matter of human error.

All programmers are fallible, every programmer has made mistakes. Some minor, some major. An immutable blockchain prevents a bait and switch, but what if the contract is already flawed, either due to an error, or a backdoor. Audits hope to solve this problem, but as we see in the corporate world, nothing is perfect.

It is possible in a far distant era where code is largley generated by super advanced AI, this may become a non issue. In such a reality, corporate networks would also be perfectly secure.

Additionally, this notion of immutability can provide a false sense of security. Very recently there was a scam called “solmangofarm” which many regarded as a transparent ponzi scheme. The reality was more nefarious.

They asked a trusted member of the DEFI community, 0xfoobar to audit the contract, which he did. He announces he has been hired to do this, and then they (while he is working on it) use his name as an excuse. They claim he found a vulnerability, and that users need to migrate their funds to be safe.

While foobar was working on the backend, the frontend was modified to replace the contract, not with an audited one but with a drainer. Everyone who accessed the new contract was drained for their entire wallet.

You could argue this is user error, I would argue this proves circumventing the aforementioned advantage is trivial. Unless this technology is only to be used by experts.

Cryptocurrency

Next the author discusses what blockchains are famous for, cryptocurrency. I believe the comments about Bitcoin’s ‘guaranteed’ scarcity are reasonable, and I could agree “Googlecoin” is absurd, but it’s not a serious proposition.

Bitcoin can operate as a store of value, as long as it is viewed to be of value. Bitcoin is among other things, seen as a world currency, while I don’t think it will ever function as one, it reduces complexity. Thousands of coins on the other hand, is a return to the medieval system of barter (see: Roubini’s point above).

On the other hand, a key issue with many critical interpretations of Bitcoin, is that it’s scarcity prevents it from being bond by a fundamental value. I can agree with the points made by Nassim Taleb’s “Black paper”, but no forces exist to ever force bitcoin to converge with it’s theoretical value.

The “Modern” Barter System

In the next chapter we move on to Tokens, firstly touching on why Enterprise blockchain is a stupid idea (yes, that is a literal database). The author describes blockchain as ‘multiplayer’, where it’s key utility is when used by 2 unknown parties.

The author explains tokens using OOP terminology. This strikes me as a weird analogy. I’ll agree tokens are simpler than every entity in existence creating their own coin, but it adds needless complexity as opposed to simply, you know, using a currency?

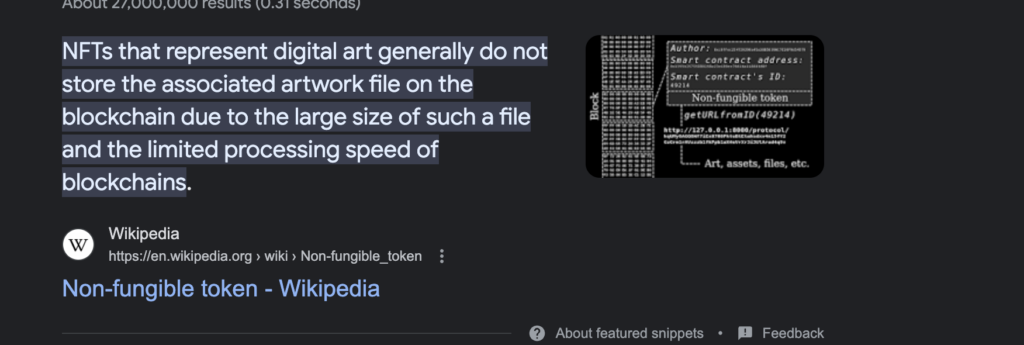

NFTs are mentioned as an example of how you can own anything on the blockchain, but there’s a problem here. Besides the meme of copy + pasting NFTs, in a very literal sense, the NFT is not on the blockchain, but some server on the regular internet. This is (as wikipedia explains) due to the critical limitation of the blockchain I tried to mention earlier, the capacity.

Allowing immutable image storage is not exactly a great or practical idea either, given the potential for illegal content. IPFS exists, but in practice public gateways have to follow local laws.

The creator of the NFT sells you a ‘record’ of ownership, which is a true fiat in that it has no value beyond it’s communities accepted value. It is possible to (via a regular contract) assign some value to the offering, but at that point nothing has changed.

You can sell ‘anything’ as an NFT, but you really don’t achieve anything by doing so. It could have an application in say 100 years from now as an authentication, but that is inherently a usecase that takes time to be accepted. Similarly you can tokenize ‘real world assets’, but there is no practical benefit to doing that over existing structures.

In practice almost all of these examples are created purely to capitalize ont he hype of NFTs. During the peak of the NFT craze of 2021, almost anything packaged as an NFT could fetch more money than in any other means.

Ownership

Now after a brief explanation of crypto, we get into the authors core vision, about ownership. My question is, why does any of this matter, and secondarily, this seems more like a good argument against DRM, rather than an argument for NFTs.

There’s a very big difference between physical assets, and digital, and that is cost of production. It’s very hard to ‘own’ something that can be copied freely, any DRM can & will eventually be cracked on a long enough timeline.

The same can be said for the house & car analogy. Houses require land, materials to build & are necessary for life. The value the author mentions comes from the necessity and scarcity of land, not that ownership inhernetly creates wealth.

The same on a smaller scale could be said for physical books, an out of print book is valuable because it is desired and of limited supply. Unless the goal is to deprive future readers of access to books by limiting the supply of ebooks needlessly; this value creation mechanism cannot exist.

As a personal example, I own many terabytes of stock market data, prices, earnings data, calls, etc. I consider this database valuable, but the value, and acquisition of such data is fundamentally a different thing than physical ownership.

The author criticizes many ideas as skeumorphism. I believe the concept of NFTs is a skeumorphism of real world ownership itself.

Imagined Scarcity

A core justification for NFTs having a value is the idea they are scarce, but are they actually scarce. I had considered writing a full piece on this back when NFTs were, hot but ultimately never finished it.

My core issue with NFTs is similar to Bitcoiners arguments against Altcoins. Scarcity does not create value, scarcity can enable value to exist in conjunction with demand. Bitcoin would be worthless if bitcoins could be freely copied, but if I were to launch alicecoin, which would do nothing and have a supply of 10 million (fixed), it would not inherently be valuable.

What differentiates the hypothetical Alicecoin from Narumicoin? The same pool of real money chases all of these assets. In the NFT world, you have Apes, then some knockoffs, IE Monkes. For punks there are bunks (binance chain punks).

They can derive value from the communities acceptance that only punks are punks & bunks are worthless knockoffs, but that’s the real source of value. Digital scarcity is inherently artifical.

The idea that NFTs will somehow bring back the lost revenues from the pre streaming era is silly. A key aspect of the transition from buying to streaming is the reality of getting a lot more music per $. NFTs can transiently (IE during crazes) provide additional money to artists, but this is a side effect of speculation, not a sustainted desire to pay more for the same thing.

False Continuum Fallacy

A very core part of what I would call the web 3 narrative is based around the false continuum fallacy. The following is written by GPT-4 regarding the false continuum fallacy, I believe it represents my point well.

The False Continuum Fallacy, also known as the fallacy of the false range or the continuum fallacy, occurs when it is assumed that a progression or relationship exists on a continuum when, in reality, the distinctions involve qualitative changes that don’t support such a seamless or linear progression. This fallacy can be particularly persuasive when discussing history and proposing hypothetical futures because it simplifies complex transitions into an easily digestible narrative, often overlooking significant nuances and differences.

Using History and a Hypothetical Future

When applying the False Continuum Fallacy to history and hypothetical futures, one might present historical events or developments as if they were part of a smooth, inevitable progression towards a specific future state. This approach can be misleading in several ways:

- Oversimplification: It reduces complex historical phenomena to simple stepping stones, ignoring the multifaceted causes and effects, as well as the potential for non-linear developments or radical shifts that don’t fit into a simple progressive model.

- Imposing Narratives: By presenting history as a continuum leading to a specific hypothetical future, it imposes a narrative that may reflect bias, wishful thinking, or speculative assumptions rather than a balanced analysis of historical trends.

- Ignoring Discontinuities: Real historical progressions often involve discontinuities, setbacks, and paradigm shifts that cannot be accurately represented on a simple linear continuum. For example, technological advancements, social changes, or political upheavals often result in changes that are not merely incremental improvements but represent fundamentally different approaches or understandings.

- Predictive Fallacy: Assuming that because things have progressed in a certain way in the past, they will continue to do so in the future, ignores the unpredictability of future developments and the impact of unforeseen variables.

(end of AI Generated Content)

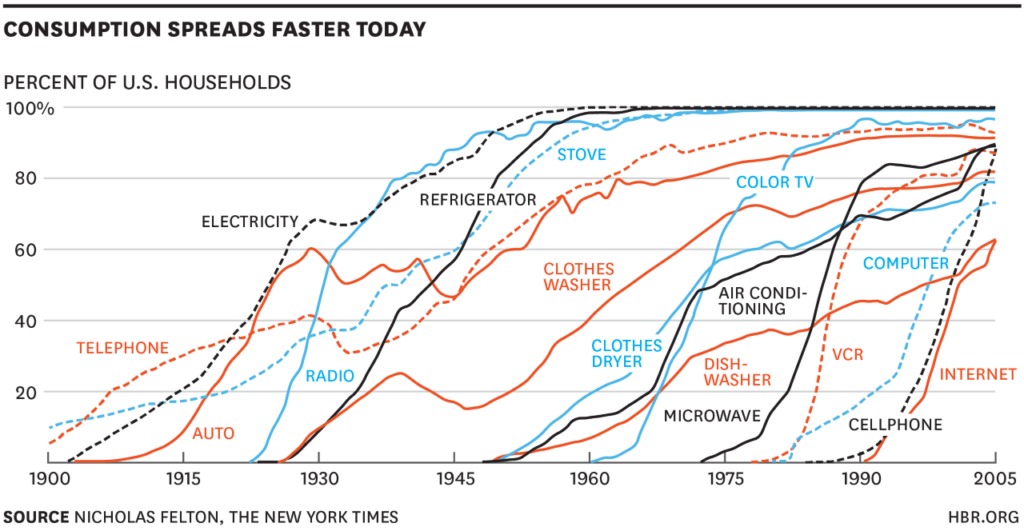

The following graphic is frequently affixed with a new technology at the bottom, often times Bitcoin or Blockchain. The problem is this graphic only shows technologies which reached mass adoption, rather than the millions that didn’t. Imagine if instead we had the betamax instead of the VCR.

There are many famous misses (Paul Krugman’s fax machine), which can trigger a sense of fomo, but you have to see the other side of the coin to make a fair judgement. You read and hear much about the development of successful technologies, less so of the major failures.

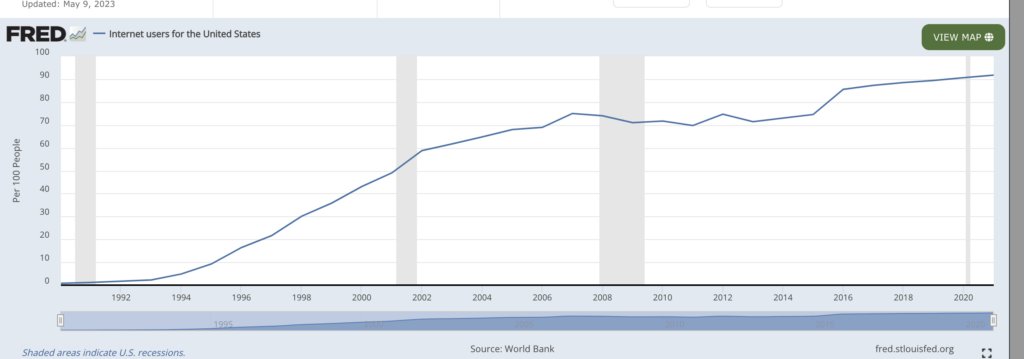

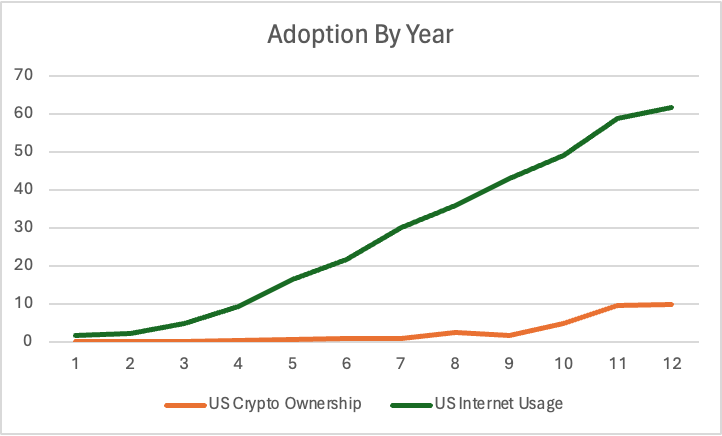

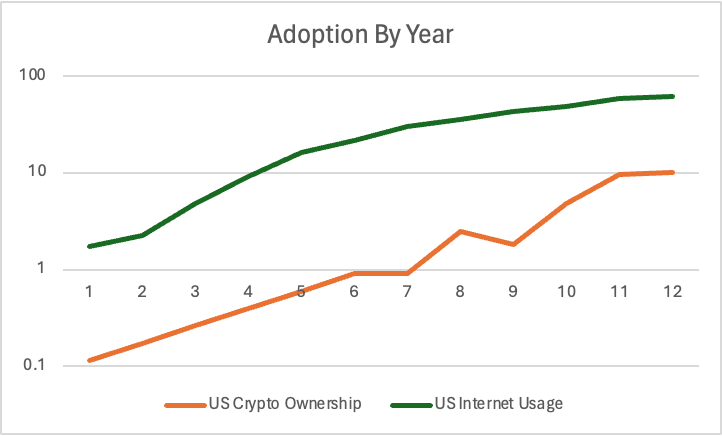

One final point I will make is regarding misleading charts comparing internet and bitcoin (or crypto) adoption. It’s extremely important to choose the correct start date of internet mass availability, which meaningfully started in the 1990s in the US, and later elsewhere (1995-98 in the developed world, 2000s elesewhere).

The above graphic is popular among crypto users, but it is also a total lie. The Internet was essentially US-only prior to 1995, and crypto was availble globally since 2009 (or 2010 if we count exchanges). It is arguably a silly comparison to compare downloading software to subscribing to a service that requires physical infrastructure.

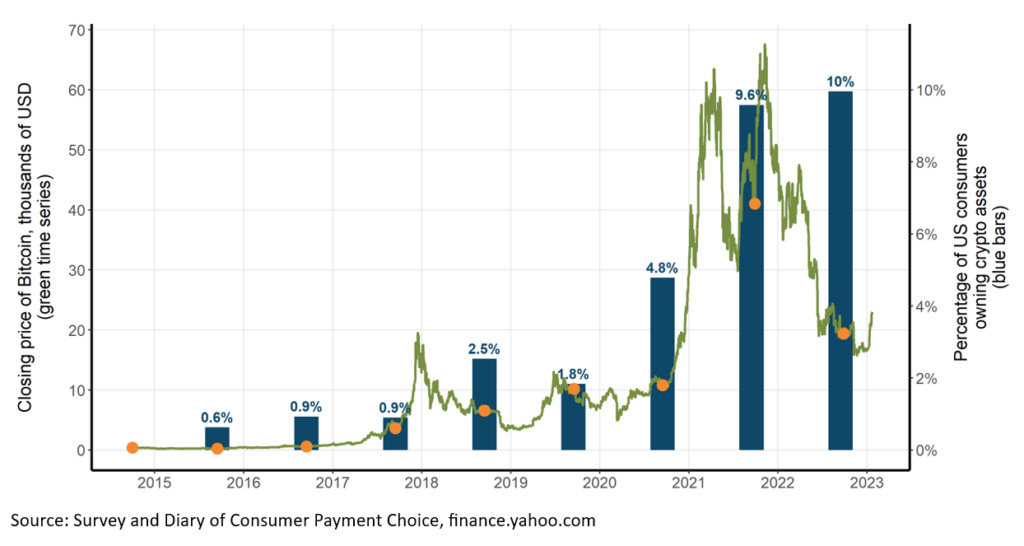

I have struggled to find accurate data regarding crypto usage in the US or the world, but if we use the federal reserve surveys, we can get an idea. I am going to be generous and declare that 2011 = 1992 (as opposed to 2009 = 1992), I will also make the data available so you can do your own comparisons. For years prior to 2014 I estimated a constant 50% annualized growth rate, as no reliable data exists.

The result we get is above. While using a log plot on percentage points seems unreasonable, I will do it to make it easier to view.

Why focus on the US? Because global access to the internet was extremely hetrogenous in the early years, nobody in Rural China had internet before the mid 2000s.

I have simply posted the data below in plaintext in CSV format.

Internet Year,Crypto Year,US Crypto Ownership,US Internet Usage

1992,2011,0.113848416,1.72

1993,2012,0.1724976,2.27

1994,2013,0.26136,4.8

1995,2014,0.396,9.23

1996,2015,0.6,16.41935296

1997,2016,0.9,21.61640097

1998,2017,0.9,30.09319659

1999,2018,2.5,35.84872446

2000,2019,1.8,43.07916264

2001,2020,4.8,49.08083159

2002,2021,9.6,58.78540388

2003,2022,10,61.69711712Distruptive Vs Sustaining Technologies

The author considers AI to be a sustaining technology for tech giants, which I find puzzling. I think he explains the core idea of a sustaining vs disrupting technology quite well, but I cannot agree with the categorization here. VR perhaps could be.

I think there’s a more important factor that has lead to the lack of big tech involvement in tokens, legality. Wealthy companies have a lot more to lose than startups by potentially breaking laws, tokens have been found to run afoul of securities laws in the US.

The Internet Trifecta

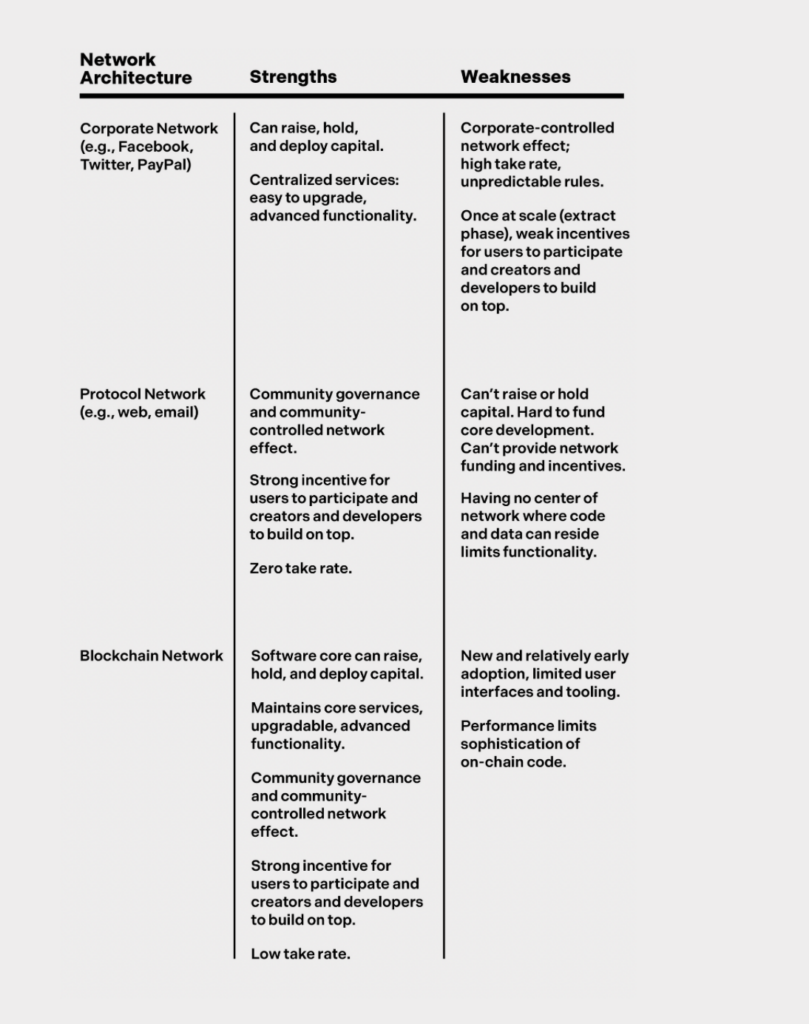

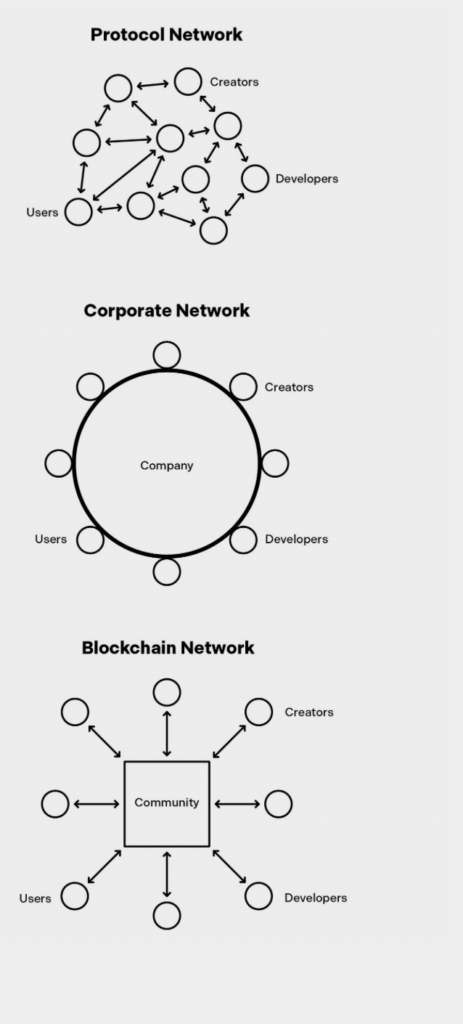

To clarify on the authors terminology, the authors describes three kinds of networks.

Protocol Networks: Protocols such as the WWW, email and DNS. Decentralized, and noncommercial. Unfortunately it’s not until page 170 that we get into Federated networks, such as the fediverse & Bluesky.

Corporate Networks: Centralized for-profit networks such as online platforms.

Blockchain Networks: The authors term for web 3.0 /cryptocurrency based networks.

A lot of the above graphic is agreeable, but I think the author is far too jaded on the incentives of corporate networks (see: YouTube, creator monetization), and overly optimistic on the scalability of blockchains. The number of blockchain networks that would grow to a scale where they could be functionally independent of their developers is neglible (even Bitcoin was slightly affected by the PoW sharing chain BItcoin Cash ABC’s decision to enact a developer tax).

It’s worth clarifying that blockchain networks / DAOs are not democratic by users, they are democratic by dollars (in their native tokens), which tend to be centrally owned by the creators. Publicly traded corporations (IE Twitter) are also democratic in this matter.

As a real world example, Billionaire Twitter user Elon Musk decided he was unhappy with how the platform was being run & bought it. I see no functional difference between this dynamic and a dao. Every shareholder was bought out by Elon for a premium, and the users have no more or less say (I mean legally, I am not commenting on Elon’s management) than they did otherwise.

A protocol on the other hand has no such system. Email doesn’t have an overbearing moderation team, nor a billionaire user who may seek to fire them. These actions are then built by users (as filters) instead.

Perhaps I am misinterpreting this graphic, but it seems to confirm my thinking. Other than replacing the circle with a square, how is this graphic different? The arrows are added to both decentralized options, but that seems like misdirection.

On Cathedrals and Bazaars

Next we get into a brief history of Open source and then, a reference to the popular book “The Cathedral and the Bazaar”, describing 2 approaches to software, with a clear preference in favor of the “Bazaar” approach.

I personally am not a fan of the book, I think repeats the author of read write own’s mistake, the assertation (the mythical man hour does not apply over the internet), without evidence.

Take Rates

Take Rates, as described in Read Write own is the concept of how a network (especially corporate networks) absorbs the value (advertising, fees) rather than distributing to creators. The internet heavily disrupted take rates for retailers, and destroyed travel agencies outright, the author proposes the same could happen for social networks.

I think it is worth pointing out, a very large amount (for Twitter >100%) of income is going to the underlying operation of these services, most of which are not profitable. YouTube had the advantage of a very patient corporate parent (Google) who would subsidize them for more than a decade before profitabilty.

The author highlights a hypothetical world where instead of 20 billion of 150 billion being paid out, 130 billion was paid out. The problem with this idea, is that barring meta, a huge swath of this money is spent to actually run the infrastructure, not just enrich shareholders.

To quote Elon Musk, “Twitter was a non profit for most of it’s existence before I bought it, then advertisers pulled out and we had to make major cuts”. Pre acquisition the company had rarely had profitable quarters, and now that seems like a pipe dream.

What’s glossed over by the author is that while protocol networks do have no take rates (you own everything), there are inherent costs. For most people who would try to start a blog, you will spend more on hosting than you will be paid by advertising.

Dismissing Federation

The author does (starting at page 170) talk briefly about federation, and federated networks, but glosses over the issues, and ultimately claims that the solution to a federated network is in fact a blockchain. Many of the same problems (including lack of adoption), occur on both.

“Because of their architecture, federated networks have difficulty matching the smooth user experiences of other networks. Corporate networks eliminate friction by storing data in centralized data centers while blockchain networks eliminate friction by storing data on a blockchain. (Recall that blockchains are distributed, virtual computers that can store arbitrary information, including social data.) Federated networks, like protocol networks, have no centralized components, and thus no central place to store data, which is a problem because, as history shows, even small amounts of friction can stymie adoption.

Excerpt From

How might one fix this? Imagine another system on top of a federated network that collects data from the individual servers and aggregates that data into a single, centralized database. Sometimes servers will disagree, so the system needs a way to adjudicate disputes to decide which servers best represent the network’s true state. Well, guess what? We’ve just invented a blockchain. Blockchains provide a mechanism for centralizing data while keeping control of that data decentralized.”

Read Write Own

Chris Dixon

This sounds good in theory, but is an utterly insane idea in practice. The core problem with doing anything intensive “on the blockchain” is that every node must possess the knowledge of every other node.

For Twitter, if we excluded media, a 2013 blogpost estimates that tweets use 224 GB / day. Excluding the issues of copyright & csam, this is clearly unfeasible to store on every node, and a massive waste of computing power.

“Attestations can also address the proliferation of bots and “counterfeit persons.” AI is going to make bots so sophisticated that users can’t distinguish between real and fake people. (We’re already beginning to see this happen.) In this case, the answer is to attach attestations to social network identifiers instead of pieces of media. For example, The New York Times could attest that the @nytimes handle on a new social network is controlled by the same organization that controls the website www.nytimes.com. Users could examine the blockchain, or rely on third-party services that do, to verify the authenticity of these attestations.

Excerpt From

Such authentication systems would help defeat spam and impersonators. Social media services could display”

Read Write Own

Chris Dixon

I find this excrept to be more evidence of a lack of understanding of federated systems. This is exactly what Bsky (note my handle @shinoji-research.com) & mastodon are able to offer. There’s no need for a blockchain or a token, we already have DNS.

One can also trivially create a page on their domain linking to their real social media profiles.

Looking from the wrong perspective

Many entrepeneurs have made the same mistake the author does, looking at disruption of platforms as a matter of creator incentives. Ask Mixer how well paying creators more works in terms of building a platform, it’s a piece but nowhere near the whole puzzle.

Viewers will go where they get the best experience, not where their favorite creators demand them to go. Modern social media is heavily driven by proprietary algorithms, which maximize viewing times. In some cases censorship can drive viewership elsewhere, but even then, it’s almost always a small fraction of what they would get on large platforms.

Seignorage as incentives

The author seems to believe the main advantage a crypto system has over a protocol network is that the tokens can function as incentives, or mitigate access costs. The problem is this is predicated on the same logic as the weimar republic.

The subsidy is either temporary, or you have a token with unpredictable and infinite supply. Many of these subsidies are taken advantage of by so called “Sybil’ers”, people who use multiple fake profiles to extract additional value.

One of the most successful platforms based on the seighnorage model is Steemit, a reddit clone where users are paid by the issuance of “Steem Backed Dollars“. SBDs are in many ways similar to Terra Luna, but due to the nature of their economy & community, it has thus far survived. The problem with the ecosystem is that while SBDs are roughly worth $1, that value is achieved by printing Steem, which is not guaranteed to be worth anything.

Shareholder Capitalism is not a form of Democracy

The idea of ‘community’ control is repeatedly mentioned, but is inherently unrealistic. As the SEC often points out, almost all tokens are functionally securties, and much like regular securities, they will be held largely by investors rather than community members.

Even if creators are paid in these tokens, would they hold them, would they ever reach majority control? Imagine if YouTube (who recently announced paying $70 billion) had paid all of that in GOOGL shares, or hypothetical TUBE shares, which would be worth around 180 Billion.

Creators would have 1/3 in theory, but in reality they would sell those shares (or most of them) to finance living & creating expenses. As a result, investors would still own the platform, and you would simply have the shareholder capitalism dynamic we already have.

“

Excerpt From

The best way to mitigate this risk is with a broad distribution of tokens. Token ownership should be widespread across the community such that no voting bloc has too much power. This requires thoughtful faucet design, as discussed in the previous chapter.”

Read Write Own

Chris Dixon

The author acknowledges this issue, but in typical fashion dismisses it by instead explaining that it is ‘easy’ (I guess via airdrops) to distribute the supply to prevent such blocs. The problem is people will sell their tokens, the idea you can just prevent this is delusional.

Some networks also have a second line of defense against plutocracy: splitting voters into two groups. The approach resembles the bicameral systems used by national governments, such as the U.S. Senate and House of Representatives. In a blockchain network, one house might consist of respected community members chosen by a foundation, while the other might consist of token holders. Sometimes the foundation house can veto proposals made by the token house if it deems the proposals overly self-interested. Other times certain responsibilities, such as technical and financial decisions, are split across housesExcerpt From

Read Write Own

Chris Dixon

And now we’re back to quasi corporate networks.

Pyramid Shaped

Now after an explanation of how the app stores are hard to break into due to saturation, tokens are explained as an alternative because of peer to peer ‘evangelism’. This sounds more like an MLM, than promoting an app.

The idea that you cannot have evangelism without a token is bizarre, you can ask OpenAI (who never spent a $1 to advertise ChatGPT). What you do need is something NEW & compelling, that people actually want, and find to be novel enough to mention to their friends.

Tokenomics

Later on, the concepts of tokenomics and then speculative cycles are introduced, with the concept of faucets & sinks to describe supply and demand for cryptocurrencies. A lot of the theory here is sound, but as the author acknowledges (although downlplayed), speculation in practice dominates the valuation of cryptocurrencies.

The author alludes to the concept of hype cycles, and uses the cycle concept some coiners do to describe periods of time. I think the key problem with this narrative is that in a traditional sense, you have a bubble followed by a crash where valuations trend towards a fundamental mean.

In cryptocurrency (for people who want to use the cycle concept), the problem is that has largley not happened. Barring perhaps ethereum, and exchange tokens, the top 10 list has shown no correlation to the fundamentals, or ‘cashflow’ of these projects.

Almost every defi science experiment has been outperformed by Dogecoin (as has Bitcoin). A project that is well known to be a joke, but is purchased mainly because of it’s perceived accessibilty from it’s low price.

This is a very stark contrast to the dotcom bubble. In the 2000s, most dotcoms went to 0, and many remain far below the peak. A very small select few of the original darlings (Amazon.com, Microsoft, Apple), went on to achieve great new highs, along with many post 1999 upstarts (Google, Meta).

I think it’s more useful to view the entire hype period of crypto (2016-2021) as one event, that is still disinflating if you exclude bitcoin & stablecoins.

The Casino vs The Computer

The author finally touches on the legality of tokens, and about how crypto is seen (& in the real world used as) a casino. I would agree that the enforcement which ends up hitting serious attempts, rather than unserious fraud is unfortunate, but registration exists for a reason.

The 2018 ICO wild west was an interesting experiment in why allowing unregistered securities offerings to the general public is not a good idea. Earlier ICOs were mostly earnest intentions, that raised vastly more capital than could be justified, the later ones were often times hilarious frauds. One of my personal favorites was “block broker“, a token designed to prevent exit scams, that exit scammed.

A humorous, although well meaning project was Dentacoin, it was a cryptocurrency launched by a Dentist in Denmark. The token, despite only be usable at a single dentists office was valued at over $1.8B at it’s peak.

What’s unfortunate is in many ways, the death of the ICO bubble paved the way for the casinos dominance. While many of these projects were frauds, investment in them was predicated in excitement of a new technological prospect.

By 2021, almost everyone was on the same page. Cryptocurrencies exist to be bought to sell higher, and on the VC side, tokens exist to be acquired cheaply and distributed higher. It’s hard to see a solution for this, or a genuine usecase for tokens that cannot be met by existing securities.

Malware is Law

“Sending money should be as easy as sending text messages”

Is that really a good idea? Is having your entire financial life with no guardrails immediately irreversibly transactable a good idea?

There are plenty of examples throughout history where liberty has been violated by banks, or governments. A recent one would be the Canadian trucker convoy, where the freezing of bank accounts was recently ruled to be unconstitutional under the charter.

On the other hand, not all refusals by a bank to transact are infringements of liberty. To the average person thieves & fraudsters are a far more serious & real threat.

If you’ve ever pranked a phone scammer, you’ll notice how they will have some alibi to give you to avoid raising suspicion with compliance. Even with these tall tales, banks will often times catch on and prevent large transfers to “cybersecurity departments”.

Crypto eliminates these guard rails, this may be positive for political activists facing oppression, but not so much for the average person. In the early days of the giveaway scams, obvious fake accounts were able to earn hundreds of thousands of dollars worth of crypto with “10x your bitcoin” elon musk giveaways.

The heat of the moment is a powerful thing. Given a few more minutes you’d obviously realize the premise is absurd, but that’s the drawback of instant unrestricted transacting.

“Although internet payments are now common, they are still high friction. Users have to enter credit card information. Incidents of fraud and charge-backs are high. Credit card fees are between 2 and 3 percent, low by the standards of other internet take rates, but high enough to prohibit many possible uses. (As discussed earlier, mobile platforms charge much higher fees, up to 30 percent of app store transactions.)”

Excerpt From

Read Write Own

Chris Dixon

I believe this is a distrotion of reality. Yes credit card fraud is a real problem, however unlike stories of people losing their life savings due to clicking the wrong link, there are guardrails, chargebacks. The idea chargebacks are a negative aspect of the incumbent system is probably the worst idea presented in this book.

There are some situations (controversial websites, XXX material) where companies or people are legitimately poorly served by existing solutions, but a lot of this is due to bad legislation rather than technology. The PATRIOT act created a dynamic in the US, where the consequences for platforming terrorism is extreme, but the consequences for deplatforming innocents are nonexistent.

I believe crypto (especially privacy coins) has a legitimate niche in the payments space, but that is very different from an internet-level innovation hype masters are making blockchain out to be. The existence of choice is a good thing.

Decentralized Finance

DEFI actually gets relatively little mention in the book. He mentions the obvious criticism of DEFI (that it only works within it’s own little box) and doesn’t really have a solution, other than if the rest of the crypto narrative succeeds, that would be less of an issue.

I think DEFI suffers from a lot of the same problems I mention above, although the edge cases justifying it are far slimmer than payments. The main usecase of popular decentralized finance platforms is borrowing, often times for short-selling, another speculative tool.

Uniswap is arguably the most used & successful decentralized App of all time, and does function well for it’s purpose. Unfortunately due to the trapped in the box issue, it is overwhelmingly used as a casino.

It also provides a very clearly worse experience than any centralized financial service. For speculation that tradeoff is accepted as a means of avoiding securities regulations (CEXes are not going to list BitcoinHPOSI), for practical usecases, that makes less sense.

There are more complex DEFI exchanges, but many of them end up having a (sometimes hidden) centralized layer. I don’t want to start a flame war over whether these L2s are decentralized or not, but the crucial limitation of the blockchain does hit.

I will assume the author is fairly unfamiliar with the inner workings of financial markets in stating that 46k TPS is a ‘internet scale’. It is a reasonable scale for a credit card, but not for global trading systems. Every morning on the NYSE open, over 1 million trades per second occurs, along with at the close.

It is extremely hard to view DEFI as anything other than an incredibly complicated regression of modern financial systems.

The Metaverse

The metaverse and crypto are often times seen as being interwined, although they can also be separate. The term metaverse was invented in a 1992 Science Fiction novel, Snow Crash. The author repeats the questionable claim that Blockchains are computers, which is then used as a justification for why it is integral in 3d virtual worlds.

A comparison between video game cosmetics and digital goods is not a novel idea. It’s a common justification for why digital assets should have value, but I find the transferability arguments silly. If I could hypothetically transfer my Sentinel Vayne skin to Palworld, what exactly would I do with it?

“RWT” Real world trading exists in any videogame where it is at all feasible, and where individual item trading is not (IE League of Legends), account selling is a successful business.

Common cosmetics are typically cheap, costing a few $, while some discontinued items can have dramatic resale value. It’s not impossible to use a blockchain to represent this state, but it doesn’t really add any value. Ultimately assisting in real world trading simply enhances the casino aspect.

The AI Crossover

Definitions:

Training: Pretraining or finetuning on a massive corpus of text to produce a large language model.

In-Context: Putting content into the AI model (equivalent to copy + pasting an article into chatgpt), either manually or automatically using browsing features.

First of all, I think there is a very important distinction between training (almost unanimously agreed to be fair use), and real time in-context summarization. The author does not make this distinction when discussing the sustainability (or lack thereof) of AI, and it’s impact on the content economy.

The existence of AI tools is very likely fair use, that does not mean putting copyrighted material as a direct input gives you a right to the output. Especially when the input is not purely uncopyrightable facts. AI does lead us into a world where uncopyrightable material is dramatically more important (as an example, weights of neural networks are almost certainly uncopyrightable), but I struggle to see the fit for the ‘blockchain’ here.

The author seems to not understand, or not mention that (with current technology) incorporating real time information into an LLM is impossible through pre-training. This is why OpenAI has licensed content from many news providers for use in ChatGPT, despite fair use protecting pre-training.

Symbiotic relationships here are naturally forming, without any need for smart contracts, or external solutions.

I will venture in the realm of prediction and say, I believe the role of human created content in AI pretraining is a temporary state. As Microsoft’s PHI model has shown, superior results can come (now that we already have the models from mass pretraining) through machine generated training data.

Final Thoughts

While I doubt this book is in fact a best selling hit, it’s not a terrible read if you’re interested in cryptocurrency, or understanding pro cryptocurrency arguments. I do not think I share much of a vision with the author, but it was still a reasonably interested book.

I think over the next 2 years, with more data regarding crypto usage, it will become clearer, whether the 2022 hump in ownership represents a long term peak, or a stalling area.

Leave a Reply