I think most people still do not understand the problem with luna, which is a uniquely poor design. While there are similarites, I hope to contrast these two projects, and explain why Luna was always guaranteed to fail.

There are ~3 ways to make a stablecoin. Backed by the underlying (Tether, USDC, modern DAI indirectly via the above), backed by an asset of value with over collateral (original DAI). Backed by an asset with additional mechanics besides overcollateralization.

Why did luna blow up?

This is the category of ‘innovative’ stablecoins that LUNA & Ethena belong to, but that does not mean they are the same. Luna is something that has always shocked me, given coiners love to spam this graphic.

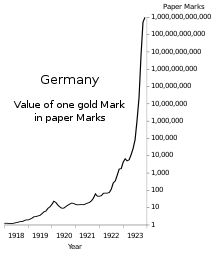

The core problem with Luna is obvious, Luna (the token) plays the role of the weimar mark, and UST is the gold denominated debts. The trouble with foreign denominated debts is the exponential factor. Every asset printed reduces the marginal value by each, and with an external debt the quantity needed to print to settle the reaminder of the debt also increases, leading ot a death spiral.

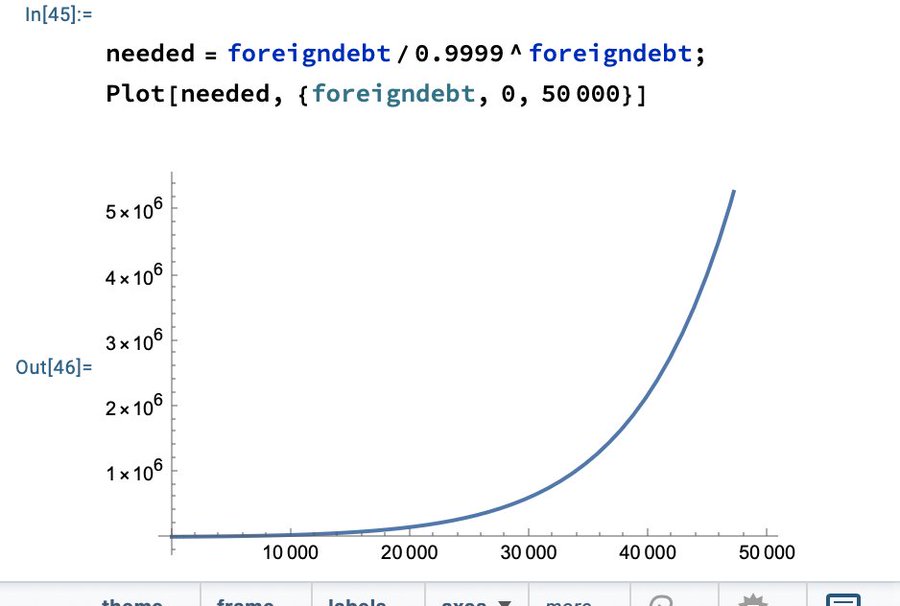

As an example, assuming 1 bp of value is lost on every transaction, this is how a hyperinflationary spiral would represent the number of tokens needed to be issued to cover foreign debt of a given size. 5k only needs 8k, by 30k we need over 1 million. This is the mechanism of how luna blew up, a more accurate model would also take into account, as the situation gets worse that public confidence declines, further accelerating the debasement.

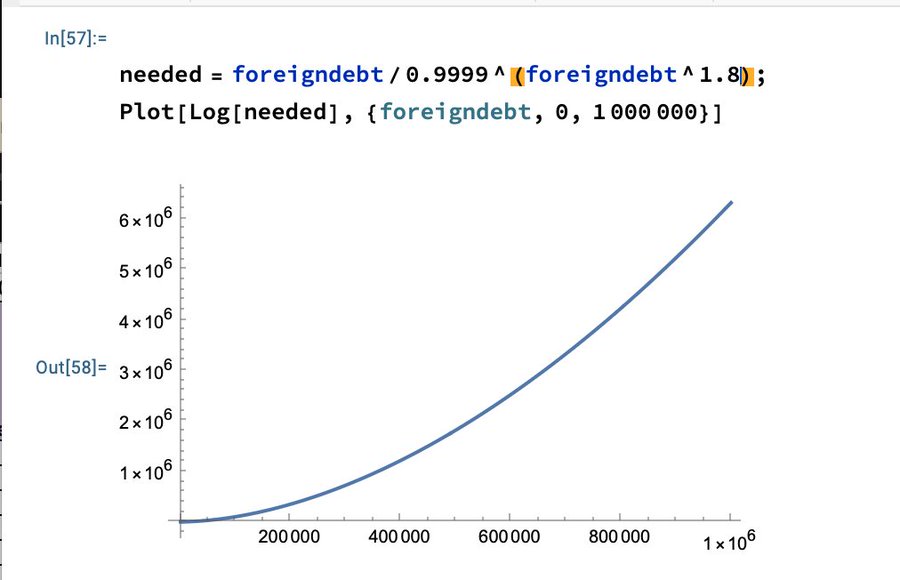

This is what leads to situations like the weimar chart where it appears to be parabolic despite being plotted on a Logarithmic chart (note the Log function).

How did this work at all?

The secret ingredient is crime. As recent court documents have revealed, the first Luna collapse (May 2021) was prevented by Jump stepping in to keep the price up. This eliminated the confidence part of the problem.

The biggest lure into this mess was Anchor protocol, which Terraform labs themselves propped up, as demand far exceeded the number of borrowers. The price of Luna went up both from speculation, and all the new UST demand burning ocins, everything was great until it … wasn’t.

Enter Athena

So now that we understand what was wrong with Luna, lets take a look at Ethena. Ethena is an alternative to collateralized stablecoins, that seeks to provide stability & returns by using Ethereum as collateral and hedging the dollar value on the futures market, in addition to staking.

Now the obvious red flag here is the yields, they seem as high as Anchor’s, and anyone will question a 20% interest rate as extremely risky. What’s the trick here?

The documentation (if you can read past the techno babble and muh 8 billion nonsense) is quite good.

There are 2 sources of yield, the first is fairly consistent. Ethereum is a proof of stake coin, meaning that you can earn rewards by staking your Ethereum. As we mentioned above, to hedge the price, Ethena are using futures contracts, which also have a premium (or discount), this is the second source of yield.

But is this Sustainable?

The obvious question is “is this sustainable” and the answer is of course no, but not in the same sense as Luna. Ethena is not backed by the publics confidence in Ethena, in fact it’s more the opposite, it’s ‘backed’ by ETH liquidity, and the yield is derived from longside bias on Ethereum futures.

I imagine if this project takes off meaningfully, Ethereum’s futures premiums will start to diverge from other coins, and that will drag returns. If futures end up going negative more than the staking income covers, then holders will lose money.

The difference is rather than losing everything, holders would have a negative APY. The other risk is a tail risk on the exchanges being used to hedge, this could lead to a substantial drawdown, but due to diversification would be unlikely to lead to a wipeout.

You can read more from the documentation on this risk management here:

I hope this was interesting / helpful. Myself / Shinoji Research are not affiliated with Ethena in any way, I just wanted to shed some light on this, and also clarify what people are getting wrong about Terra Luna.

Leave a Reply