FTX has recently filed it’s widely awaited Chapter 11 bankruptcy exit plan, in this plan we learn exactly how the distributions will work, for customers and some other creditors.

The Breakdown (from Thomas Braziel on X):

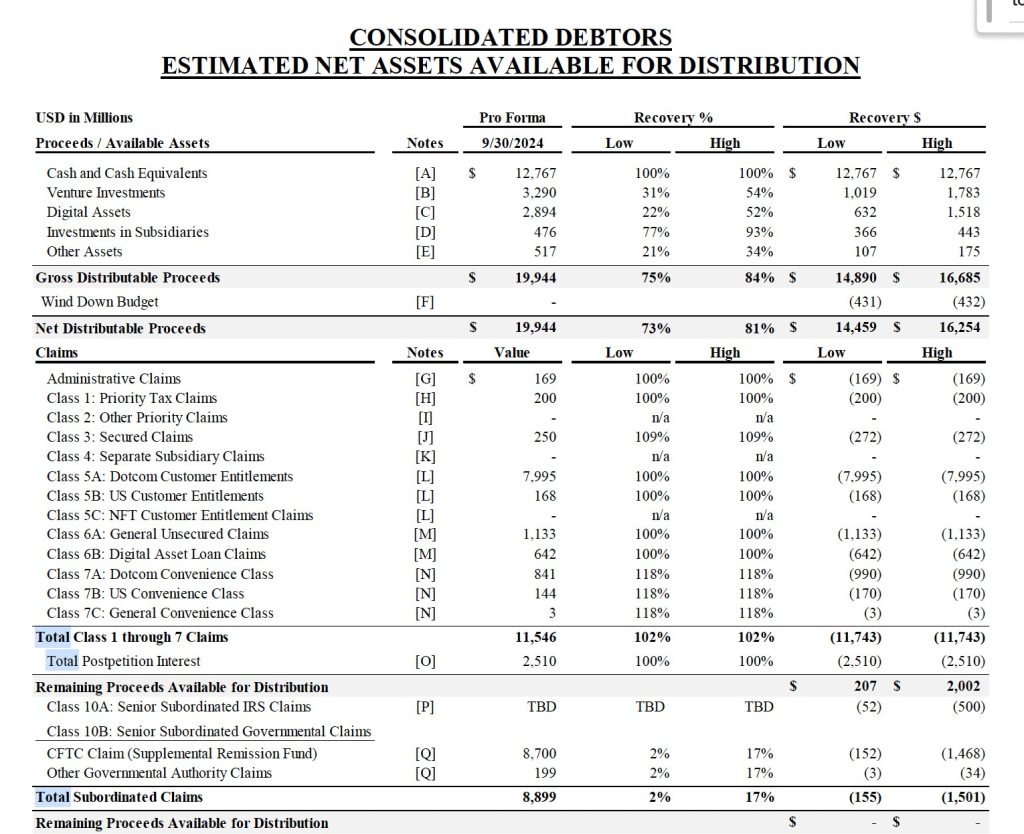

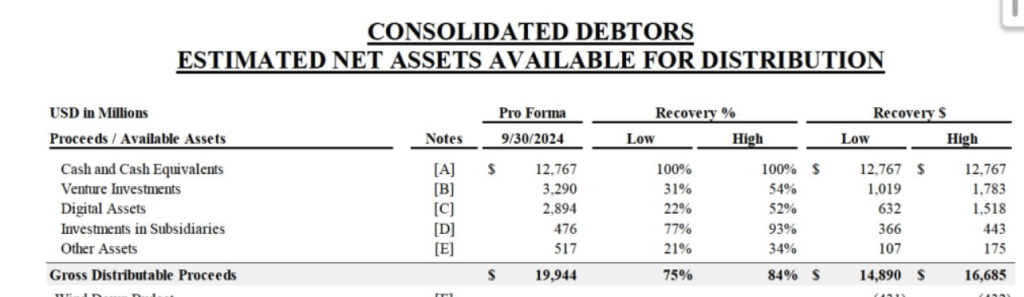

From realized funds alone, enough liquidity is available to cover customer payouts and the variablity (the difference between optimistic and pessimistic estimates) will end up going to the IRS & CFTC. I can understand the frustration in terms of how that played out, but now lets see % wise how well / bad people are off.

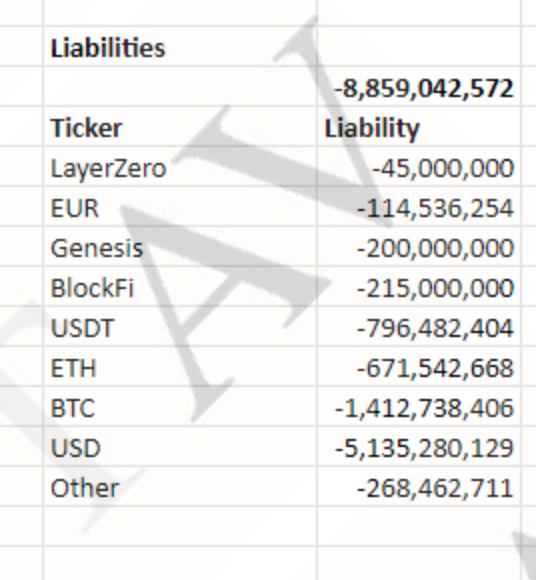

In order to determine the recovery, lets throw back to SBF’s spreadsheet.

Customer liabilites were as follows, for dotcom (to me the omission of SOL is odd, given I assumed it would be a major coin on dotcom, but it isn’t listed separately in the sheet). Inevitably some of that other column will be other coins, and some will also be samcoins which went to $0, for the sake of conveinience, I am going to index that column as if it was all Solana.

So then what were the recovery rates? Well assuming that petition date values roughly = SBF’s numbers (taken on Nov 9th), here’s my estimates. If you held Solana on FTX, you got screwed, if you held other coins, it’s rough, but managable. USD holders rejoice.

One other way of thinking about this is rather than thinking in terms of what they could have made, we could think in terms of what they paid. All of the dollar assets are going to be the same, but what about the coins?

I’m going to use a 677 period moving average (roughly corresponding to the period when FTX was at it’s peak) for each coin as a way of answering that question. A bitcoin on FTX’s last day would have on average been purchased for $39k (-61%) , Ethereum 2400 (-54%) and Solana $73 (-81.66%).

It’s an objectively imperfect calculation, but it seems reasonable. The ultimate result is a recovery rate of 54% for ETH, 46% for BTC and just 21% for Solana.

Overall, it is both dissapointing to many, but also better than anyone could have accepted a year ago. Could it be better, yes, if it was up to me, I would distribute 100% to USD and all excess to coin holders, but working that out is tricky.

Under even the optimistic plan, and ignoring costs, they would fall slightly short of the total recovery figure of $17.3B, especially if the non government $3.7B to other creditors is excluded. FTX would need about $20B in assets to payout full, accounting for property.

Dishonorable Mentions

One final dishonorable mention in this saga goes to Justin Sun, who’s Tron grandstand ultimately cost anyone who took him up on his offer the majority of their claim. If you purchased TRX while it was trading at 0.3 on FTX, you only got a value of 0.05 in your claim, leading to a devastating loss.

Unfortuantely it seems like he is just going to get away with this, as neither the bankruptcy estate nor the victims have pursued the matter.

Leave a Reply